GS Paper III

News Excerpt: India debuted its first-ever 50-year bond at a cut-off yield of 7.46%.

More details on the news:

- The government sold 100 billion rupees ($1.2 billion) of the 2073 bond to fulfil a long-standing demand by life insurance companies, notably the Life Insurance Corporation of India.

- The inaugural auction of India’s 50-year bond saw robust demand, signalling a growing interest in ultra-long-term securities among insurance companies and pension funds.

- Before the debut of this paper, India’s longest-tenor government bond was the 40-year paper for which the cut-off yield was at 7.47%. The yield on 30-year paper is at 7.46%.

Significance of this Long-Term Bond Issuance

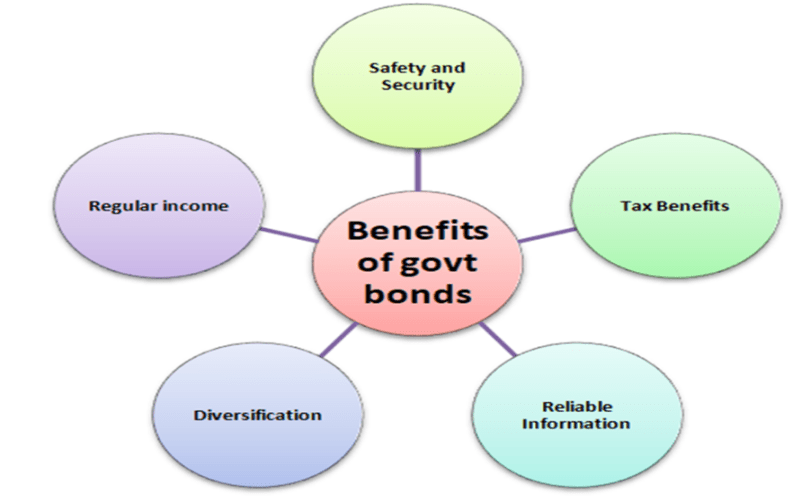

- Market participants had long been urging the RBI to introduce ultra-long bonds, and the strong response to the 50-year bond suggests a promising future for such offerings.

- The government’s issuance of long-term bonds can potentially help in extending the tenure of debt sales and managing interest costs effectively.

Why demand for the 50-year bonds?

- Particularly from prime investment choice.

- Over the past few years, insurers and pension funds have increased their purchases of government debt due to the strong demand for their financial products.

- Insurance products often necessitate an additional 10 years of bond duration to align with asset-liability management gaps.

- A 50-year bond will likely lead to a flat yield curve, elongating the maturity of the government's debt while keeping its overall interest costs in check.

- The issuance of longer-maturity debt will also extend the weighted average maturity of outstanding bonds.

What is a bond?

- A bond is a debt instrument in which an investor loans money to an entity (typically corporate or government) that borrows the funds for a defined period of time at a variable or fixed interest rate. Bonds are used by companies, municipalities, states and sovereign governments to raise money to finance a variety of projects and activities. Owners of bonds are debt holders, or creditors, of the issuer.

Bond yield

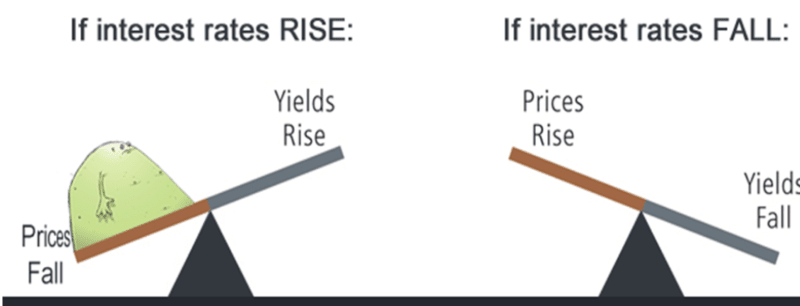

- Bond yield is the return an investor realises on an investment in a bond. A bond can be purchased for more than its face value, at a premium, or less than its face value, at a discount. Price and yield are inversely related, and as the price of a bond goes up, its yield goes down.

Relation between interest rates and bond price & bond yield

- Interest rates: These rates are set by RBI and influence the overall cost of borrowing and investment returns. Higher interest rates generally attract foreign investors seeking better returns, while lower rates may deter them.

- Bond Prices: Bond prices have an inverse correlation to interest rate movements; that is, if market rates increase after a bond issue, the cost of these bonds declines, and vice-versa.

- Bond Yields: Bond yields reflect the fixed interest payments as a percentage of the bond's current price. Rising interest rates lead to higher bond yields, making bonds more attractive to foreign investors seeking better returns.

Types of Government Bonds in India

- Government Securities (G Secs Bonds): G Secs Bonds or Government Securities are long-term debt instruments issued by the Government of India through auctions conducted by the Reserve Bank of India (RBI).

- State Development Loans (SDLs): SDLs are issued by the State Governments, and RBI coordinates the actual process of selling these securities.

- Treasury bills (T-Bills): These are short-term debt instruments issued by the Government of India and are presently issued in three tenors, namely, 91 days, 182 days and 364 days.

- Inflation-Indexed Bonds (IIBs): The principal value of these bonds is adjusted for inflation, and they offer a fixed interest rate on top of the inflation-adjusted principal.

- Sovereign Gold Bonds (SGBs): SGBs are dated government securities denominated in grams of gold. The RBI Gold Bond scheme allows investors to invest in gold without holding physical gold.

- RBI Floating Rate Bond: Unlike traditional fixed-rate bonds, the interest rate on these bonds is not fixed but fluctuates periodically based on changes in a reference rate. In the case of RBI Bonds, the reference rate is usually the Repo Rate set by the Reserve Bank of India (RBI).

Risks of Investing in Government Bonds

- Interest Rate Risk: The Government Bonds India interest rate risk is more significant for long-term bonds, as they are exposed to price fluctuations over a longer duration.

- Inflation Risk: Inflation poses a risk to fixed-income investments like government bonds, as it erodes the purchasing power of money over time.

- Credit Risk: Though generally considered low-risk due to government backing, variations in credit risk can exist among different governments.

- Liquidity Risk: Selling bonds before maturity could be challenging, as finding buyers or selling at a discounted price may impact the overall return on investment in government bonds.

Factors Affecting Government Bond Prices

- Demand and Supply in the Bond Market: High demand for government bonds can increase prices, while oversupply can decrease prices.

- Economic Conditions: The overall economic conditions play a significant role in influencing government bond prices.

- Geopolitical Events: Geopolitical events and global developments can create uncertainty in financial markets, leading investors to seek the safety of government bonds, which can drive up prices. For example- When the US Fed hikes interest rates, capital flows more towards the US economy.

- Interest Rate Changes: Interest rates have a direct impact on government bond prices.

- Central Bank Policies: The policies of RBI, such as interest rate decisions and quantitative easing measures, can significantly impact bond prices.

- Credit Rating: The credit rating of a government or its bonds significantly affects bond prices.

- Market Sentiment: Investor sentiment and market psychology can impact bond prices.

Conclusion: India's debut of a 50-year bond with a 7.46% yield signals strong demand from life insurance companies, reflecting a growing interest in long-term securities. This issuance helps the government manage its debt tenure and interest costs, extending beyond previous 40-year bonds.

Prelims PYQ

Q. Indian Government Bond Yields are influenced by which of the following? (UPSC 2021)

- Actions of the United States Federal Reserve

- Actions of the Reserve Bank of India

- Inflation and short-term interest rates

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3