GS Paper III

News Excerpt: Embedded finance has emerged as an innovative approach to connect with a vast pool of consumers.

More details on news:

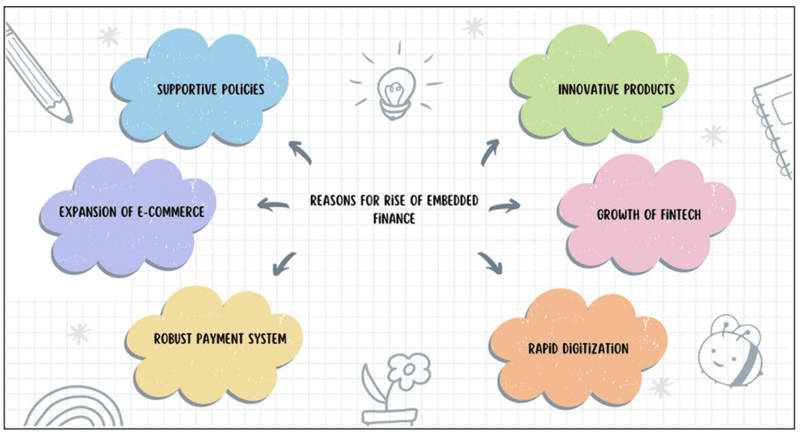

- Over the past decade, the adoption of embedded finance has surged, and digital platforms have expanded into markets that were once the stranglehold of conventional financial institutions.

- The shift has prompted a surge in collaborative ventures with non-financial entities, facilitated by open business models and partnership ecosystems.

What is Embedded finance?

- Embedded finance is the seamless integration of financial services into a traditionally non-financial platform.

- It enables customers to access financial services within the app and in context. For example, customers can make cashless payments within a ride-hailing app.

- Other examples of embedded finance include “buy now pay later” services, banking apps on ridesharing platforms, integrated payment processing on e-commerce platforms, and insurance products that are offered through travel sites and services.

- Embedded finance enables businesses in the MSME, B2C, and B2B segments to increase their customer lifetime value, monetise their customer base, and vertically scale their product offering.

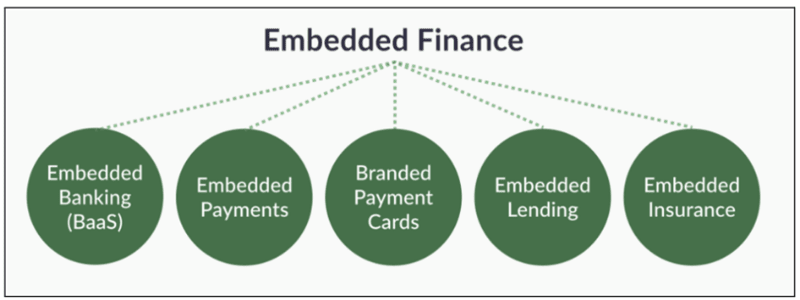

Types of embedded finance:

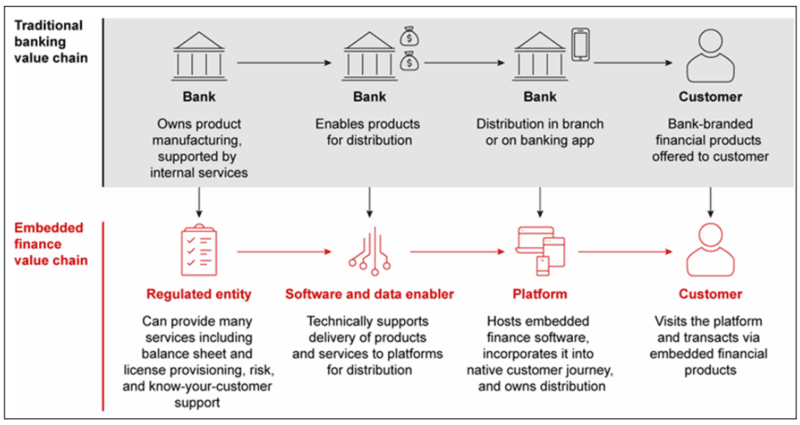

Traditional banking vs. Embedded finance value chain:

Growth of embedded finance in India:

- The payment vertical within embedded finance has undergone a substantial transformation, boasting a compound annual growth rate (CAGR) of 76 % and 28 % in transaction volume and value, respectively, between fiscal 2021 and 2023.

- The embedded finance market in India is expected to reach $530 billion by 2025.

Benefits of embedded finance:

- Financial inclusion: Embedded finance offers services that customers may not be able to find elsewhere, meaning that users can take advantage of more opportunities.

- Convenience: When a company offers embedded finance services, its users gain access to a greater number of payment and financial options.

- Streamlined or “frictionless” payments: Embedded finance may help a business accept payments and handle transactions in a simplified way.

- Competition: Because embedded finance offers users a variety of options, it can make a company more attractive than competing services.

- Adoption of digital payments: It speeds up the adoption of digital payments, diminishing the dependence on cash and enhancing the efficiency of financial transactions.

- Contribute to economic growth: It contributes to economic growth by fostering a thriving fintech ecosystem and supporting various industries.

Challenges of embedded finance:

- Transparent and ethical business practices: There are concerns about customer protection from unfair practices, transparency, high fees, or predatory lending.

- Data privacy and security issues: There is a risk of a higher susceptibility to data breaches, fraud, and cyber security threats, potentially eroding trust.

- Robust data management: Efficiently managing and analyzing the immense volumes of data produced by embedded finance services necessitates robust data management and analytics capabilities.

- Exacerbating inequality: There is a risk of exacerbating inequality if certain populations are excluded or if access is limited to those with smartphones and internet connectivity.

- Connectivity issue: The limited digital infrastructure and connectivity may hinder the seamless adoption of embedded finance.

Way forward:

- Client-centric approach: Shift to a client-centric approach to meet individual needs.

- Collaboration: Collaborate with non-financial entities to specialize in specific industries.

- Data analytics: Leverage data analytics to expand the borrower base.

- Cross-border regulations: Implement cross-border regulations for global digital financial services.

- Infrastructure Investment: Work with government and private sector partners to improve digital infrastructure and connectivity.

Conclusion:

Embedded finance is a promising trend in the financial industry, offering unique opportunities for financial institutions to reach new customers, but it also poses some challenges that need to be addressed for sustainable growth.