Rise in US bond yields impacts on India

GS Paper - III

Context

The ongoing increase in bond yields in the US may result in further declines in the Indian equity market.

More details on the news

- The 10-year US Treasury bond yield has surpassed 8%, the highest level in over 16 years, and nearly 45% higher than the 25-year average yield of 3.3%.

- With this increase, the benchmark bond yields in the world’s largest economy have risen by almost 100 basis points (bps) since the beginning of the current calendar year (2023).

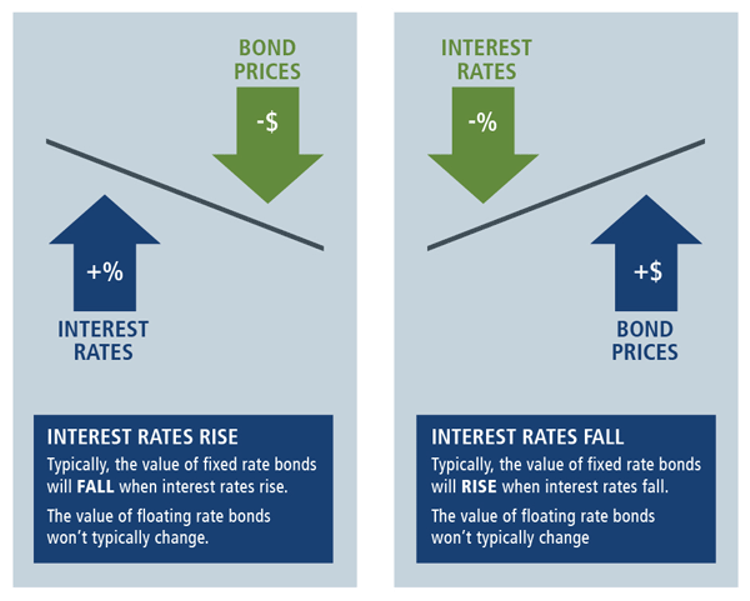

- Historically, there is a negative correlation between the yield or interest rate on risk-free government bonds and the price of risky assets such as equities. Consequently, the recent rise in US bond yields has led to the repricing of equities.

|

What is the bond?

What is bond yield?

Relation between interest rates and bond price & bond yield

|

Bond yields as an economic indicator

- High yield as risk indicator: A high yield indicates greater risk. If the yield offered by a bond is much higher than what it was when issued, there is a chance that the company or government that issued it is financially stressed and may not be able to repay the capital.

- Investor confidence: Government bonds are relatively more stable but low demand at auctions indicates low investor confidence in the country's economy.

- Mirror of GDP growth: The bond yield mirrors GDP growth, but the relationship between yields and economic activity is more complex, especially in the case of developing countries like India.

- Factors impacting yield: A whole host of factors including recessions, inflation, and bank rates set by central banks can have an impact on bond yields.

- In developing countries like India where the government is among the biggest investors in the economy, bond yields can be a useful parameter in assessing economic health.

- Unlike in countries where private enterprise drives the engine of growth, the trend of high bond yields is worrying in the case of India since it reflects on investor sentiment that is not entirely favourable to the prospect of the government taking on more debt.

Reasons for recent bond yield rise in the US

- Increased U.S. Treasury Debt Issuance: The S. Treasury surprised the bond market when it announceda significantly larger need to raise money than expected.

- Inflation Expectations: Bond yields tend to rise in an inflationary environment. A recent spike in U.S. bond yields has come alongside expectations for inflation.

- Japanese effect: When yields rise, it is a sign that someone somewhere is selling bonds, given that yields rise when prices fall. Japanese investors may be selling the U.S. 10-year benchmark and buying their country’s counterpart as yields look increasingly inviting there.

- Strong economic data in the US and hawkish comments from the US Federal Reserve officials have raised bets that the interest rates will remain higher for longer, leading to a spike in bond yields.

- Recently, US job openings unexpectedly rose, pointing to tight labour market conditions that could compel the Federal Reserve to raise interest shortly.

Impact of rising US bond yields on India

- The movement in the yield on US Treasury bonds affects the Indian equity market through foreign portfolio investment (FPI) in equities.

- When bond yields decline in the US, investment in Indian equities becomes more attractive, and FPIs become net buyers, leading to a rise in stock prices and an expansion in the market’s P/E multiple.

- Conversely, when bond yields rise in the US, FPIs become net sellers and withdraw their capital, resulting in a decline in the Sensex P/E multiple.

- For example, FPIs turned net sellers in September as US bond yields surged, leading to a broader market decline.

- The Sensex is now down 2,600 points from its September highs, and the P/E multiple has contracted by 100 bps in the past month due to selling by FPIs.

- In total, the index’s trailing P/E has contracted by 400 bps since the end of December 2021, compared to a 330-bp rise in US bond yields.

- Many analysts foresee further downside for Indian equities, as the overall adjustment in the Indian market has been much less than the rise in US bond yields.

- For instance, the Sensex P/E multiple has remained unchanged since the beginning of the 2023 calendar year, despite a 100-bp rise in US bond yields.

- Impact on gold prices: With the rise of US bond yield, the gold price falls. Gold prices have fallen nearly 3% in the month of September 2023.

Way forward

- Diversifying export markets: It involves trade agreements with countries in Asia, Africa, or Europe to reduce dependence on the US as a primary export destination.

- Stabilize the exchange rate: To stabilize the exchange rate, the RBI can use its foreign exchange reserves to purchase rupees and sell dollars, thereby preventing excessive depreciation.

- Increase the repo rate: When the US bond yields rise, the RBI can increase the repo rate, making borrowing more expensive, and this may reduce capital outflows from India.

- Better financial regulations: Strengthen banking and financial regulations to ensure that banks can absorb potential shocks from volatile capital flows and exchange rate movements.

- Attract FDI: Encouraging FDI can help finance economic growth without increasing external vulnerabilities.

- Increasing interest rates: To prevent capital outflows, RBI can consider adjusting its own monetary policy by increasing domestic interest rates to maintain a competitive interest rate differential with the USA.

Conclusion

Thus, India should adopt a proactive and well-coordinated approach involving monetary, fiscal, and structural policies to effectively manage the potential challenges posed by increasing US bond yields. Additionally, the measures adopted should align with the prevailing economic conditions and international market dynamics.

PYQ Prelims

Q1. Indian Government Bond Yields are influenced by which of the following? (UPSC 2021)

- Actions of the United States Federal Reserve

- Actions of the Reserve Bank of India

- Inflation and short-term interest rates

Select the correct answer using the code given below.

- 1 and 2 only

- 2 only

- 3 only

- 1, 2 and 3

Q2. What is/are the purpose/purposes of the Government’s ‘Sovereign Gold Bond Scheme’ and ‘Gold Monetization Scheme’? (UPSC 2016)

- To bring the idle gold lying with Indian households into the economy

- To promote FDI in the gold and jewellery sector

- To reduce India’s dependence on gold imports

Select the correct answer using the codes given below:

- 1 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Paintbrush swift Butterfly (Baoris farri)

Context

The paintbrush swift butterfly has been sighted for the first time in Himachal Pradesh.

About

- It is a butterfly species of the Hesperiidae family. Its distribution is common in northeast, central and south India, and rare in north India.

- Other closely related species are Blank swift, Eight swift and Rice swift.

- Their habitat is declining due to scarcity of larval host plants, an increase in pesticide use, deforestation, and climate change.

- Legally protected in India under Schedule IV of the Wildlife (Protection) Act, 1972.

Dogra Architecture

Context

Jammu and Kashmir administration and the Indian National Trust for Art and Cultural Heritage (INTACH) are collaborating to preserve Dogra Architecture.

About

Dogra Architecture style

- Dogra Hindu kings introduced architectural elements in Kashmir between 1846 and 1947.

- Its key features include collonaded walkways, decorative pilasters, exposed moulded brickwork, dome-topped arch terraces and "mehraab" style doorways.

- Mubarakmandi was the centre of Dogra culture. The domes at Mubarakmandi illustrate how shikhara and dome styles can coexist.

- Bahu Fort, Jasrotra Palace, and Billawar Palace are some other examples of the Dogra style. The local sandstones and pebbles are utilized in the construction.

- The Rajput monarchs of Jammu executed and studied the Jharokha style of the balcony, which was inspired by the Rajasthani style of architecture.

- The 12th century saw the creation of Krimchi temples in Udhampur, which combined Jammu architecture with Hellenistic building styles. Purmandal, a holy site for Hindus, was established by Gulab Singh.

Comprehensive Test Ban Treaty (CTBT)

Context

Russia has recently announced its withdrawal from the Comprehensive Nuclear Test Ban Treaty (CTBT).

About

- The Comprehensive Nuclear Test Ban Treaty (CTBT) is a treaty that aims to prohibit all nuclear explosions, whether for military or peaceful purposes.

- Currently, 187 countries have signed the treaty, with 178 of them having ratified However, the treaty has yet to legally come into force.

- North Korea, India, and Pakistan have not signed the CTBT. China, Egypt, Iran, Israel, and the United States have signed but not ratified the treaty.

- Currently, nine countries possess nuclear weapons, while 35 have nuclear power and research reactors.

- The CTBT establishes a comprehensive verification regime to monitor and detect nuclear test explosions. It has three main components -

- International Monitoring System (IMS) which has more than 300 global facilities and can detect seismic (shockwaves through the ground), hydroacoustic (sound waves in oceans), infrasound (ultra-low-frequency sound waves inaudible to the human ear), and radionuclide (radioactive particles and gases from a nuclear explosion in the atmosphere) signals.

- International Data Centre which receives data from the IMS network and shares it with member states.

- On-site inspections will be possible once the treaty is enforced.

- Despite being stuck in a ratification impasse, it had a positive impact on global nuclear non-proliferation. Since 1996, only ten nuclear tests have been conducted - two by India and Pakistan each, and six by North Korea.

Project UDBHAV

Context:

‘Project UDBHAV’ was launched during the inauguration of the Indian Military Heritage Festival.

About

- It aims to effectively integrate ancient wisdom with modern military pedagogy through interdisciplinary research, workshops, and leadership seminars.

- It will facilitate the emergence of previously under-explored thoughts and theories related to strategic thinking, statecraft, and warfare, foster deeper understanding, and contribute to enriching military training curricula.

- It is an attempt to bridge the gap and sustain the knowledge creation, of Indian heritage, in terms of grand strategy, strategic thinking, and discussions on statecraft.

Bharat Tex 2024

Context:

India to host the world's largest textiles event, Bharat Tex 2024.

About

- It is scheduled to be held from 26-29 February 2024 in New Delhi.

- It is being planned as a consolidated and unique platform to position and showcase India’s entire textile value chain and also highlight strengths in fashion, traditional crafts, technological innovations, and sustainability initiatives.

- It is envisaged to be the biggest textile event at the global level, with exhibitors and buyers from over 40 countries.