Tax contribution by States needs to be revisited

Relevance: GS III (Economy)

- Prelims: Finance Commissions and their Roles; Taxation System in India;

- Mains: State development and taxation structure in India; Significance of GST regime;

Why in the News?

The share of the States in the divisible pool is shrinking despite their carrying a higher burden of expenditure.

- Chief Ministers have expressed their concern about dwindling State revenues in a NITI Aayog meeting chaired by the Prime Minister.

About Dwindling State revenues and Finance Commission since a long:

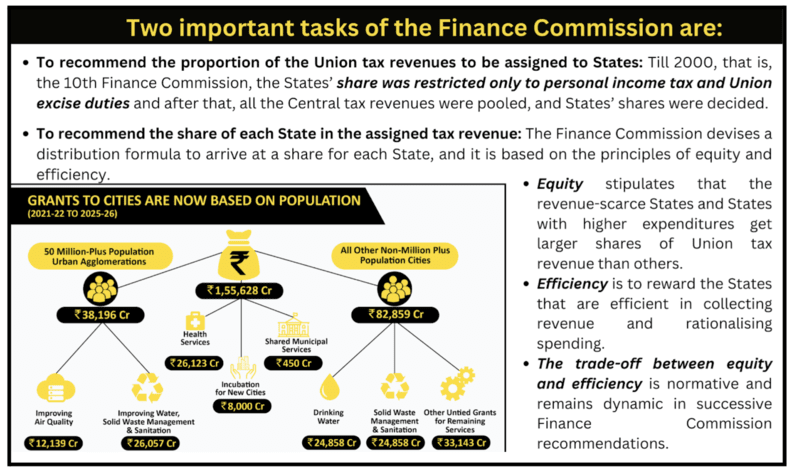

- The Finance Commission’s important job is to recommend a distribution formula specifying each State’s share in the part of the Union tax revenue assigned to States. Such distribution formulas have a few weighted determinants.

- After First FC: Some States have been arguing that their contributions to the Union tax revenue have been higher than others and, therefore, they rightfully have higher shares in the Union tax revenue.

- First Seven FC: A State’s level of development and economic structure decides its tax contribution.

- However, Finance Commissions had assigned only 10% to 20% weight to this efficiency indicator.

- Population, a chief indicator of the expenditure needs of the State, was given 80% to 90% weight as far as income tax distribution was concerned.

- First Eight FC: During this period, tax contribution with very little weight was a determinant in the distribution formula.

- After Tenth FC: The tax contribution was dropped from the distribution formula. The Commission has recommended a single distribution formula for both income tax and Union excise duties. Thus, the Finance Commissions have always favored assigning more than 75% weight to equity indicators.

- The tax contribution by each State is a good measure of efficiency, and the Goods and Services Tax (GST) regime creates an opportunity for its inclusion in the distribution formula.

- Since 2000, Central Tax Revenues included Tax effort and Fiscal discipline (formula for the distribution of pooled) as efficiency indicators with a weight of around 15%.

- Tax effort is broadly defined as the ratio of the own revenue of a State to its Gross Domestic Product.

- Fiscal discipline is the proportion of own revenue to the revenue expenditure of a State.

- In the 15th Finance Commission, the distribution formula had a tax effort with a weight of 2.5%, and demographic performance, an indicator of efficiency in population control, was given a weight of 12.5%. The remaining 85% weight was distributed among equity indicators of per capita income, population as per the 2011 Census instead of the conventional 1971 Census, area, forest cover, etc.

Challenges:

- Difficulties faced by states:

-

- States from which large volumes of income tax revenue have been collected argued to consider and assign a higher weight to ‘tax collection’ as an indicator of tax contribution.

- The origin of income is essential to estimate States’ contributions to income tax revenue, which is difficult to identify, as a person may pay income tax from one State though the income earned is from other States.

- Difficulties faced by Finance Commission:

- Successive Finance Commissions have assigned 10% to 20% weight to income tax revenue collection/assessment in the distribution formula for income tax revenue because collection is not a good indicator of contribution.

- In the case of distributing revenue from Union excise duties, the entire distribution was based on population or other indicators of expenditure needs such as area, per capita income, proportion of Scheduled Caste/Scheduled Tribe population, and some indicators of social and physical infrastructure needs.

- In the case of Union excise duties, the value of taxable products consumed in a State is essential to decide its contribution.

- Due to the unavailability of proper consumption statistics, contribution was never a determinant in the distribution formula for Union excise duties.

What are the issues with Tax contribution in the distribution formula in India?

- Varied States demands: Even though some States have been arguing for increasing the weightage for efficiency indicators such as tax effort and fiscal discipline, these indicators have received lower weights as they are unstable.

- The Fiscal Discipline: It is affected by contractual payments such as salaries, pensions, and interest payments, as well as the tied-grant-induced expenditures of States.

- The tax effort is affected by discretionary tax policies and unexpected changes in actual tax bases.

- Inefficient Indicators: An objective measure of tax contribution by States, given the stability in tax structure, should be a good indicator of efficiency and be assigned a larger weight.

How can GST work as a solution?

- It is a consumption-based destination tax: GST is a consumption-based destination tax that is equally divided between the State and Central governments. In other words, the State GST accrual (inclusive of Integrated GST settlement) to a State should be the same as the Central GST accrual to the Union government from that State.

- Therefore, accurately estimating the tax contribution from a State to the Union exchequer is feasible under GST.

- It is a unified tax system: Since GST is a unified tax system, the calculations by these authors show that there is not much of a variation in the tax efforts of States. The absolute amount of GST revenue generated from each State would differ by the size and structure of States’ economies, and this marks the importance of the inclusion of this tax contribution as an efficiency indicator in the distribution formula.

- It is not affected by discretionary tax policies: A State’s GST contribution is not affected by discretionary tax policies of the State; it only reflects the accurate tax base of the State that is being exploited for the national good.

- In addition to GST, petroleum consumption is also an indicator of tax contribution to the national exchequer. The Union excise duty and sales tax on petroleum products are outside GST.

- Cascading Tax and stability in States: The Cascading Tax burden of Union excise duty and sales tax on petroleum products in addition to the burden of customs duty on petroleum imports falls on the final consumers of petroleum products in a State. Just like GST, the relative shares of petroleum consumption vary across States, but such shares are stable over time for every State.

- Therefore, the relative share of a State’s petroleum consumption reflects the relative contribution of the State to the national exchequer in the category of Union excise duties and customs duties on petroleum products.

|

Variations in two ratios- GST contribution and petroleum consumption of a State:

|

Conclusion:

The two relative contributions are fair and accurate measures of States’ contributions to the national exchequer and a good measure of efficiency. Hence there remains a persuasive case for the 16th Finance Commission, recently constituted by the Union government, to debate and include these ratios as a measure of efficiency with a weightage of at least 33% in the distribution formula.

Mains PYQ

Q. Comment on the important changes introduced in respect of the Long term Capital Gains Tax (LCGT) and Dividend Distribution Tax (DDT) in the Union Budget for 2018-2019. (UPSC 2018)

Q. Explain the rationale behind the Goods and Services Tax (Compensation to States) Act of 2017. How has COVID-19 impacted the GST compensation fund and created new federal tensions? (UPSC 2020)

Q. How have the recommendations of the 14th Finance Commission of India enabled the States to improve their fiscal position? (UPSC 2021)

Prelims PYQ

Q. What is/are the most likely advantages of implementing 'Goods and Services Tax (GST)'? (UPSC 2017)

- It will replace multiple taxes collected by multiple authorities and will thus create a single market in India.

- It will drastically reduce the 'Current Account Deficit' of India and will enable it to increase its foreign exchange reserves.

- It will enormously increase the growth and size of the economy of India and will enable it to overtake China in the near future.

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3