State of the economy - temper the euphoria

News Excerpt:

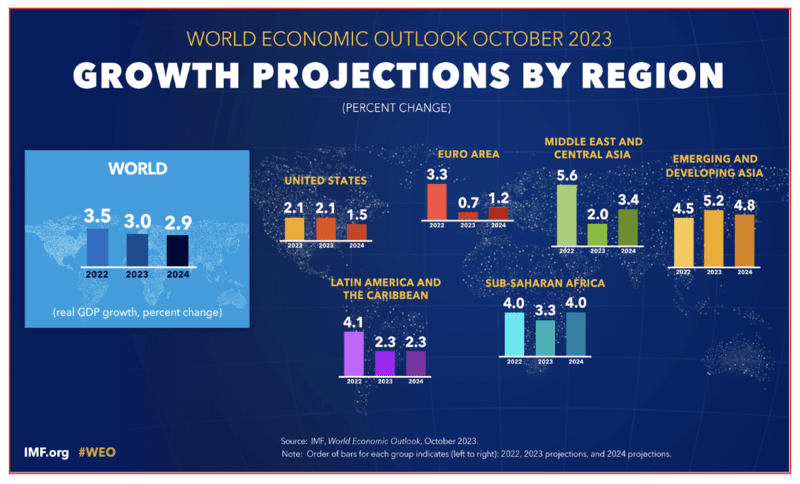

In its semi-annual report, the World Economic Outlook, ‘Navigating Global Divergences’ October 2023, the International Monetary Fund (IMF) has revised its projected GDP growth rate for India for 2023-24 to 6.3%, up from the earlier 6.1%.

Key Points:

- For India’s policymakers, it is a vindication of their short-term economic management.

- In the case of India's economic situation, we must look beyond the perspective of short-term rise to structural changes and emphasise the complexities beyond the short-term GDP growth projection.

Highlights of the report

- Economic Recovery and IMF's Projections: The GDP output contracted by 8.5% in 2020-21, which was among the steepest declines globally.

- India's real annual GDP growth slowed from 6.8% in 2016-17 to 2.8% in 2019-20 just before the pandemic. India's revised GDP growth rate of 6.3% for 2023-24 by the IMF signifies a rebound from the severe contraction during the pandemic.

- Employment Quality: The decline in industrial growth rates, especially in capital goods, has been alarming. Manufacturing growth declined from 5.7% (2004-05 to 2013-14) to 3.1% (2014-15 to 2022-23).

- India has witnessed a decade-long decline in gross fixed capital formation to GDP ratio, falling from 34.3% in 2011-12 to 28.9% in 2021-22.

- Gross fixed capital formation (GFCF) consists of resident producers' investments, deducting disposals, in fixed assets during a given period.

- While GDP recovery is favourable, concerns persist regarding employment quality and persisting inflation, particularly in essential food items impacting the vulnerable sections of society.

- Structural Vulnerabilities (Trade Deficit and Industrial Growth): The decline in manufacturing and capital goods production, coupled with a decade-long decline in fixed investment rates, poses significant challenges.

- India's trade deficit with China remains a concern, accounting for 15%-16% of its imports and contributing to a third of its trade deficit.

- The government initiated the Atmanirbhar Bharat Abhiyan in May 2020 amid the Galwan crisis to reduce dependence on Chinese imports, particularly for critical industrial products.

- Along with that, India's vulnerability to oil and food shocks persists, highlighting structural weaknesses in the economy.

- Public Investment Challenges: Contradictory claims about rising public investment might not align with the situation.

-

- The merging of extra-budgetary borrowing by central PSUs might skew the perception of increased public investment, raising questions about the actual growth in this sector.

- Public investment is around 6% of GDP, similar to pre-COVID-19 levels, despite reported increases based on budgetary statistics.

- Human Development Index (HDI): India's HDI value declined from 0.645 in 2018 to 0.633 in 2021.

- India's slipping HDI ranking reflects challenges in achieving comprehensive social development.

- Engaging with Critics: Rather than focusing solely on short-term growth projections and seeking validation from international bodies like the IMF, policymakers and commentators must engage with critics.

- Understanding and addressing the gravity of economic setbacks over the years are pivotal for a holistic evaluation of India's economic situation.

Conclusion:

While short-term growth projections offer a positive narrative, a deeper analysis reveals persistent structural vulnerabilities and challenges in India's economic landscape that need attention beyond the immediate growth figures. These challenges underline the need for policymakers to address structural vulnerabilities for sustained and inclusive economic growth; hence, engaging with critics and addressing these challenges could be instrumental in navigating India's economic future.

Prelims PYQ

Q. Which of the following organizations brings out the publication known as ‘World Economic Outlook’? (UPSC 2014)

(a) The International Monetary Fund

(b) The United Nations Development Programme

(c) The World Economic Forum

(d) The World Bank

Q. Regarding the International Monetary Fund, which one of the following statements is correct? (UPSC 2011)

(a) It can grant loans to any country

(b) It can grant loans to only developed countries

(c) It grants loans to only member countries

(d) None of these