A blueprint for climate finance at COP28

GS Paper III

News Except:

Climate change has prompted us to consider alternative pathways for development. The Chair of the 28th session of the Conference of the Parties (COP28) has called for a new paradigm in climate finance.

Key Points

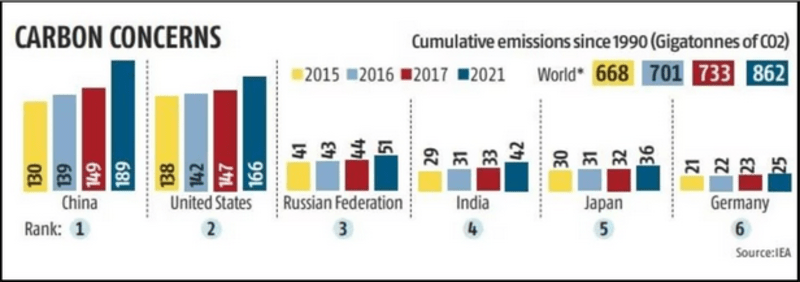

- The author suggests a different approach to climate finance, emphasising the notion of cumulative emissions rather than focusing solely on annual emissions.

- Since warming is caused by the stock of greenhouse gases (GHGs) in the atmosphere, financing responsibility should be linked to it. The global atmosphere is like a parking space for GHG emissions. It has to be either rented or regulated. Rent is a self-implementing mechanism generally preferred by economists.

About parking fee

- An annual rent or a “parking fee” from all countries for every tonne of atmospheric space occupied by their accumulated GHG emissions from 1990 onwards has many advantages.

- All countries pay the parking fee; no distinction between Annex 1 and non-Annex 1 is needed.

- It focuses on the cumulative emissions of a pathway followed by each country.

- Currently, there is no incentive or reward to remove or reduce emissions that would eventually reduce flow and, later, the stock.

- A rebate can be given for legitimate mitigation expenses. There would be an agreement and convincing audit process of how these should be accounted for.

- An illustrative parking fee of $1.0 per ton of CO2 can raise close to $900 billion annually globally. This would mean China pays or spends $189 billion, US $166 billion, and India $42 billion annually.

Suggestions for COP28:

The proposal suggests a shift from focusing solely on annual emissions to considering the cumulative emissions from 1990 onwards. This change in perspective aims to address the long-term impact of emissions.

- Most (80-90%) of the revenue would be returned to countries to support their mitigation, adaptation, and resilience efforts based on robust accounting systems.

- A portion goes to the Green Climate Fund (GCF) to assist poorer nations that might suffer more from climate change.

- Another portion is allocated to global governance to support innovation, disaster management, and capacity building.

- A smaller portion is directed towards multilateral financial institutions to subsidise interest and provide low-interest finance for climate action.

- The proposed fee could generate a substantial amount annually, around $900 billion globally, with significant contributions from major emitters like China, the US, and India.

- While the proposed amount seems substantial, compared to investments and damages due to climate change, this contribution might be relatively small.

- The estimated annual revenue from the proposed fee is approximately $900 billion globally.

Need for proposal:

- The need for developed countries to take more responsibility for financing their own climate efforts and supporting developing nations is highlighted.

- Emphasises the need for a new paradigm in climate finance, acknowledging the urgency and the inadequacy of existing funding mechanisms.

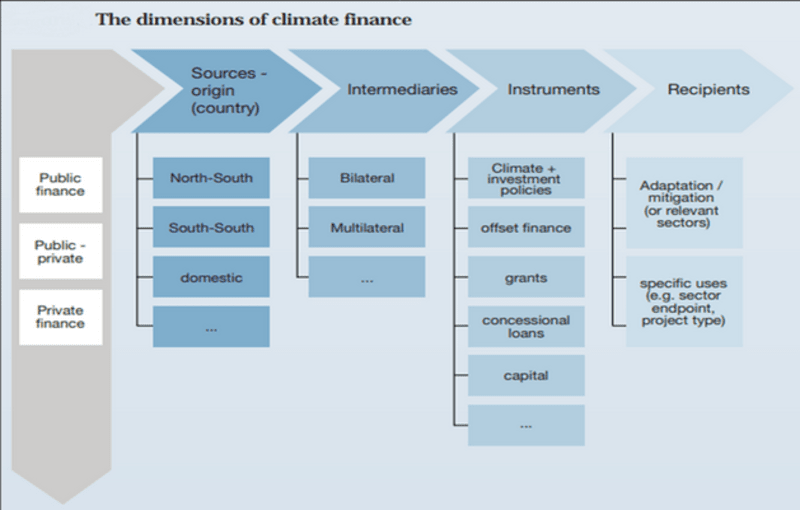

- An integrated framework with clear and stable climate policies, sound investment policies and targeted financial tools and instruments is essential to overcome barriers to private sector investments and address market failures. Scaling up climate finance to developing countries is a priority.

Challenges:

- Global Consensus: Achieving a global consensus on such a proposal will be challenging, considering differing national interests and varying levels of responsibility for historical emissions.

- Accounting and Governance: Establishing robust accounting systems and ensuring transparent governance mechanisms would be crucial for the fair distribution and utilisation of funds.

- Magnitude of Funding: While the proposed fee generates significant revenue, the question of whether it's sufficient to meet the demands of climate action, adaptation, and resilience remains.

- Balancing Interests: Balancing the needs of developed and developing countries, ensuring fairness, and addressing concerns about fairness in the fee structure would be essential.

- Implementation Challenges: Implementing such a significant shift in climate finance requires overcoming political, economic, and administrative hurdles.

India’s Role in Climate Financing

- India could push for an alternative solution that can raise climate finance with fairness to all and accelerate action by all countries for mitigation and adaptation based on scientifically sound principles.

- India could shift the discourse from annual emissions to cumulative emissions. Nearly 862 Gigatonnes (Gt) of CO2 were emitted from 1990 to 2021. The year 1990 is the reference year because all countries became aware of the threat of climate change due to the Rio Summit.

- India must advocate for reshaping the discourse on climate finance, shifting the focus from annual to cumulative emissions.

Conclusion:

The proposed "parking fee" system offers a unique perspective on climate finance by tying financial responsibility to cumulative emissions. However, achieving global consensus and ensuring fairness and effectiveness in utilisation will be significant challenges in implementing such a paradigm shift in climate finance. If the world is serious about addressing climate change, developed countries must step up financing for their own mitigation, adaptation, and resilience efforts and provide finance to developing countries.

Mains PYQ

- Describe the major outcomes of the 26th session of the Conference of the Parties (COP) to the United Nations Framework Convention on Climate Change (UNFCCC). What are the commitments made by India in this conference? (UPSC 2021)

- Explain the purpose of the Green Grid Initiative launched at World Leaders Summit of the COP26 UN Climate Change Conference in Glasgow in November, 2021. When was this idea first floated in the International Solar Alliance (ISA)? (UPSC 2021)