The severe erosion of fiscal federalism

Relevance: GS III (Economy)

- Prelims: Article 202; Article 266; Article 293;

- Mains: Fiscal Federalism; Fiscal autonomy and budget planning;

Why in the News?

Kerala CM Pinarayi Vijayan will lead a protest in New Delhi (on 8th Feb) against the Centre for “placing Kerala on a financial embargo”. The Kerala government has accused the Centre of pushing the State into a severe financial crisis by imposing a limit on its borrowings.

About:

Current Kerala Issue:

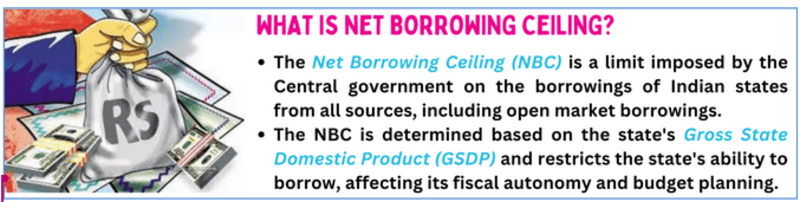

- The Kerala government has approached the Supreme Court, challenging the Centre's imposition of the NBC, which it claims has led to a severe financial crisis and violated the state's fiscal autonomy.

- Kerala argues that the inclusion of off-budget borrowings, such as those by the Kerala Infrastructure Investment Fund Board (KIIFB), in the calculation of the NBC has significantly reduced its borrowing capacity, impacting its ability to fund essential expenditures, including welfare schemes and infrastructure projects.

- The state has contended that the Centre's actions infringe upon the state's exclusive authority to regulate its finances and are in violation of the principles of fiscal federalism enshrined in the Indian Constitution.

- Kerala has moved the Supreme Court contending that the Centre’s imposition of a Net Borrowing Ceiling (NBC) on the State, which limits borrowings from all sources, violates Article 293 of the Constitution.

- Kerala has been urging the Union Government to increase its borrowing limit to drastically cut the State’s net borrowing ceiling (NBC) on market borrowings for 2023-24.

Determining State finances:

- Centre's Decision on Extra-Budgetary Borrowings: The Centre's decision to include extra-budgetary borrowings by state-owned enterprises in the total debt of the State has been questioned.

- The Union Finance Minister justified the decision by citing the 15th Finance Commission Report, which emphasizes the need for transparency and fiscal sustainability.

- However, the Finance Commission did not specifically call for the inclusion of the debt of state-owned enterprises in the Net Borrowing Ceiling (NBC).

- Constitutional Implications: The inclusion of off-budget borrowings in the NBC has raised constitutional concerns.

- The Kerala government argues that the Centre's actions infringe upon the state's exclusive authority to regulate its finances and are in violation of the principles of fiscal federalism enshrined in the Indian Constitution.

- The state has also raised objections based on the distribution of powers between the Centre and the States as per the Constitution.

- Public Account Balances: Additionally, the Kerala government has argued that the balances in the public account of the State should not be included in the NBC.

- It relies on Article 266(2) of the Constitution, which indicates that the money collected by the Central or State government, which does not pertain to the consolidated fund, can be brought under the head of 'public accounts'.

- The state contends that all activities related to public accounts fall within the domain of the State Legislature and that the Centre has no power to include the withdrawals from public accounts in the NBC.

This issue has led to a legal and constitutional battle between the Centre and the State, with significant implications for the fiscal relationship between the two levels of government in India.

From the State territory view:

- Under Article 202 of the Constitution, it is the State government that is tasked with determining the revenue and receipts and corresponding expenditure and with presenting the Budget of the State before the Legislative Assembly.

- Budget management of the State is the discretion of the State government. The territory occupied by the State executive and legislature cannot be ceded to the Union executive and Parliament in the name of fiscal management.

- According to the Kerala Fiscal Responsibility Act, 2003, Kerala shall reduce the fiscal deficit to 3% of the GSDP by 2025-2026. When a State Act provides for budget management and fiscal discipline, it is not desirable to have external supervision on the finances of the State by the Centre.

- Kerala’s fiscal deficit is reported to have significantly reduced to 2.44% and revenue deficit to 0.88% of the GSDP. In the Centre’s case, the fiscal deficit is estimated to be 5.8% for 2023-2024.

- The KIIFB was a novel idea in Kerala to fund infrastructure and development projects through extra-budgetary spending. But the State’s responsibility to fund development work cannot come in the way of it delivering justice to pensioners and beneficiaries.

Conclusion:

Not permitting the State to borrow will affect the State’s spending on welfare schemes. This can lead to a catastrophic situation in the revenue-scarce State. The character of India’s federalism is moving rapidly from cooperative to one that is destructive and annihilative. The borrowing restrictions are an example of ‘annihilative federalism’ at play.

|

BEYOND EDITORIAL What is the difference between Gross Borrowing and Net Borrowing?

Thus, gross borrowing represents the total amount of debt or borrowing, while net borrowing takes into consideration the government's total revenue, expenses, and net investment in nonfinancial assets to provide a more comprehensive measure of the government's borrowing and financial position. |

Mains PYQs

Q. How far do you think cooperation, competition and confrontation have shaped the nature of federation in India? Cite some recent examples to validate your answer. (2020)

Q. Though the federal principle is dominant in our Constitution and that principle is one of its basic features, but it is equally true that federalism under the Indian Constitution leans in favour of a strong Centre, a feature that militates against the concept of strong federalism. (2014)

Q. What were the reasons for the introduction of Fiscal Responsibility and Budget Management (FRBM) Act, 2013? Discuss critically its salient features and their effectiveness. (2013)