Improving the capability of the Indian state

“If Corruption is a disease, Transparency is an essential part of its treatment” - Kofi Annan (UN Secretary-General)

Relevance: GS II and III (Governance and Economy);

- Prelims: Terms and Concepts in News - Perverse Incentives;

- Mains: Fiscal and Political governance;

Why in the News?

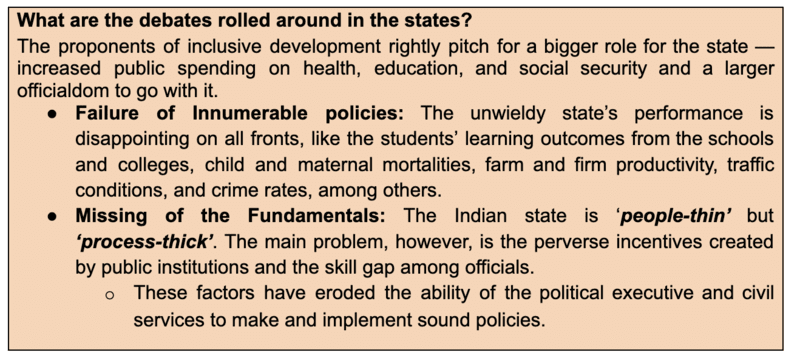

Perverse incentives created by public institutions and the skill gap among officials have eroded the ability to form and implement sound policies.

About:

- As an ordinary citizen, when try to set up a business or build a house in an urban area, a person quickly realizes that how the thicket procedures of the licenses, permits, clearances, and permissions can make life impossible.

- One can never be sure to be on the right side of the law and the circuitous regulations.

- In the G-20 group, India has the smallest number of civil servants per capita.

- The public sector share in total employment in India (at 5.77%) is half the corresponding figures for Indonesia and China, and just about a third of that in the United Kingdom.

- The per capita number of doctors, teachers, town planners, police, judges, and fire fighters, inspectors for food and drugs, and regulators is the lowest even among countries at a similar stage of development.

- The Indian state is relatively small on the other metrics, such as the tax-GDP ratio and public expenditure-GDP ratio for example, public goods provisions, welfare payments, or the justice system; it is a story of scarcity rather than surplus.

What are the Fiscal and Political Consequences of Perverse Incentives?

There is arguably the biggest but less discussed development challenge faced by India, the deficient capacity of public systems to both design effective policies and implement them.

- Promotes the Concentration of Power: For instance, there is an extreme concentration of policy making and implementation powers within departments. This arrangement generally increases power play struggles and delays landmark projects. Further, it also leads to cost overrun.

- For instance, The Indian case in point is the National Highways Authority of India, which is tasked with executing national highway projects, while policy decisions are made at the ministry level. This arrangement has drastically reduced delays and cost overruns.

- Promotes lack of Accountability and Transparency: Restrictions on the frontline personnel to decide on implementation-related issues foster a culture of mistrust and lack of accountability for poor implementation.

- The vicious cycle wherein poor delegation and a deficient state capability feed each other can be broken by delegating financial and administrative powers to the frontline functionaries, with clearly defined processes for using them.

Major Challenges:

1) The Technocratic Gap:

- Lack of technocratic skills: The top policymakers exhibit a lack of technocratic skills to govern an increasingly complex economy. In the absence of adequate capability to deal with economic, financial, contract, and other technical matters, the Centre and the States hire consultancy firms.

- There is a need to augment the strength of professional staff with market watchdogs, the Securities and Exchange Board of India, and the Reserve Bank of India (RBI).

- Securities and Exchange Commission has more than 4,500 experts to govern the corporation.

- Similarly, the professional staff strength of the RBI, less than 7,000, is tiny when compared to the US Federal Reserve which is assisted by 22,000 odd professionals.

- Paying High Costs: According to media reports, the central government paid over ₹500 crore in the last five years to outsource crucial tasks to the big five consultancy firms, i.e., PricewaterhouseCoopers, Deloitte, Ernst & Young, the KPMG, and McKinsey.

- Due to an inadequate state capability, governments at the Centre and States end up outsourcing services that are better provided by the public sector, such as primary health.

- Narrowly Scoped Audits: Another problem is the narrowly scoped audits by the Comptroller and Auditor General of India. It encourages the finance and administrative divisions in government to focus on compliance with rules rather than policy objectives.

- Non-appreciation of work done: The tendency of the other oversight agencies, i.e., the Central Vigilance Commission, the Central Bureau of Investigation, and courts to use hindsight information without appreciating the context has made the bureaucrats averse to exercising discretion in policy matters.

- Officials prefer to cancel big contracts even when granting extensions would be better.

2) The Public vs. Private sector:

The political economy of the public sector also undermines its efficacy:

- Pay: It is well known that performance-linked pay and incentive schemes such as bonuses, which work well in the private sector, are not very effective in the public sector.

- The public sector needs to attract intrinsically motivated individuals to contribute to the social good.

- Performance: Paradoxically, the relatively high salaries in the public sector reduce their performance and effectiveness.

- Because of job security and better working conditions, the risk and skill-adjusted pay in the public sector should be lower than what it is in the private sector.

- Promoting corruption: In India, due to the substantial salary hikes by the 6th Pay and the 7th Pay Commissions. For most of the skill spectrum, public sector salaries are much higher than private wages. This breeds corruption in appointments as it makes government jobs very lucrative for all, socially driven or not.

Way Forward:

- Need for Policy shift: There is a need for a new analytical framework to think about the effectiveness of the state and the policy-making process, and a nuanced perspective on many of the popular themes in public administration.

- Need for Expertise and Autonomy: A recent book, ‘State Capability in India’, suggests various measures to improve things without fiscal and political consequences.

- Experiences of countries such as Australia, Malaysia, and the United Kingdom show that separating policymaking and implementation responsibilities expedites execution and encourages innovations, making the programs better suited to local contexts.

- Need for Updating Skills: An institutionalized and regular lateral entry at the mid and senior levels can help fill the civil services’ size and technocratic gap.

- Need for Motivation: Qualified officers in non-IAS services (such as the Indian Revenue, Economic, and Statistical Services) should get a fair shot at high-level positions if they have the talent and expertise required.

- Civil servants at different levels can be provided subject-specific training under Mission Karmayogi (National Programme for Civil Services Capacity Building).

- Need for Moderate Pay: To prevent corruption in high-profile appointment procedures, the solution lies in moderate pay raises by the future Pay Commission. There is also a need to reduce the upper age limit for government jobs.

- Developing more Employment Opportunities: The high economic growth that throws up many lucrative jobs in the private sector will make government jobs less appealing for those who are money-minded. Put together, these measures can reduce corruption and increase the chances of socially-driven individuals joining the government.

Conclusion: The political will is required to address certain vital issues. This makes civil servants susceptible to political manipulation and influences their in-service decisions. To fix this, the oversight agencies must be sensitized to appreciate the context of policy decisions. They should factor in the costs associated with the actual decisions as well as their alternatives.

Mains PYQ

Q. How have the recommendations of the 14th Finance Commission of India enabled the States to improve their fiscal position? (2021)

Q. How far do you think cooperation, competition and confrontation have shaped the nature of federation in India? Cite some recent examples to validate your answer. (2020)

Prelims PYQ

Q. With Reference to the Fourteenth Finance Commission, which of the following statements is/are correct? (2015)

- It has increased the share of States in the central divisible pool from 32 percent to 42 percent.

- It has made recommendations concerning sector-specific grants.

Select the correct answer using the codes given below.

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2