GS Paper III

News Excerpt:

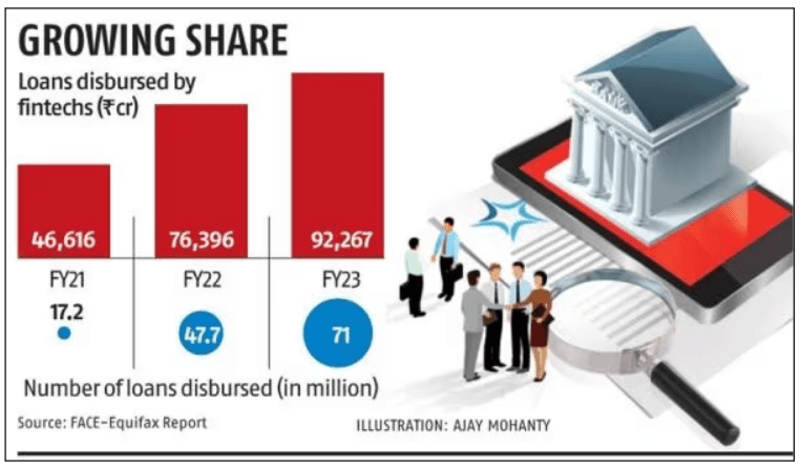

Recently, the Centre for Advanced Financial Research and Learning (CAFRAL) published a report that said fintech lending was poised to exceed traditional lending by 2030.

Key points of the report:

- Fintech lending is set to surpass traditional lending by 2030 for mid-small income.

- This projection was not only a testament to the growing influence of technology in the financial sector but also an indication of the evolving preferences of borrowers and lenders.

- According to the report, Of the 14,000 newly founded start-ups between 2016 and 2021, close to half belonged to the fintech industry.

- Fintech lending is projected to exceed traditional bank lending by 2030.

- As the sector grows, customer needs and preferences for digital financial services, paired with better accessibility, would be the major factors for fintechs to rise above traditional bank lending.

- Additionally, fintech players believe their collaboration with banks will have a compounding effect to drive the change.

- Products that are better for consumers, and better governed fintechs will emerge as larger successors in the coming days.

- This includes better credit practices, reduced costs for consumers, and democratizing credit to the masses.

- India has a strong banking regulator with consumer interest at heart.

Concerns:

- The CAFRAL report highlighted concerns such as usurious interest rates, unethical recovery practices, and data privacy issues, among others, in the backdrop of the rapid growth in digital lending.

- Borrowers are often not aware of the total costs of borrowing.

- Information on the charges is not communicated to them upfront.

- Another concern is that there are many fake/illegal apps in the marketplace.

- Users downloading a lending app cannot verify whether it is legal or not.

- Moreover, there are many instances of third parties harassing borrowers regarding the recovery of loans bothering consumers at odd hours, and using physical and violent means.

Way Forward:

- It has become imperative for fintechs to invest in technology and systems that can improve digital lending processes in practices such as underwriting, cyber security, and data privacy.

- Lending practices of unscrupulous authorized players, who are many, often color the perception of fintech lending.

- Individually, fintech lenders are constantly investing in technology, systems, and processes to improve efficiencies, underwriting, cyber security, and data privacy to overcome the challenges.

- Fintech lenders working in regulated environments follow the regulatory framework, including digital lending guidelines and a code of conduct on pricing and recovery practices.

- Self-regulation is necessary to protect the interests of customers at a time when the industry is expanding in scale.

- Collectively, fintech lenders are setting higher standards for customer protection like the FACE Code of Conduct and remitting FACE to monitor the market practices and take action if anyone breaks the rules.

- The Fintech Association of Consumer Empowerment (FACE) Code of Conduct focuses on implementing responsible and ethical lending practices.

- With so much industry diversity, innovation, scale, and speed, self-regulation is critical to customer protection.

Prelims PYQ

Q. ‘Global Financial Stability Report’ is prepared by the

(UPSC 2016)

(a) European Central Bank

(b) International Monetary Fund

(c) International Bank for Reconstruction and Development

(d) Organization for Economic Cooperation and Development

Mains Question

Q. Discuss the recommendations of the 13th Finance Commission which have been a departure from the previous commissions for strengthening the local government finances. (UPSC 2013)