GS Paper III

News Excerpt:

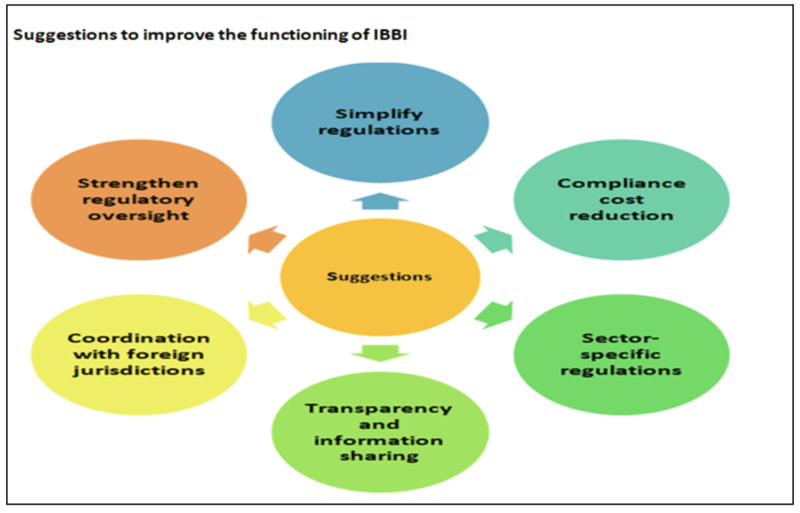

The Insolvency and Bankruptcy Board of India (IBBI) has requested input from the public and regulated entities to simplify and reduce the cost of compliance with its regulations.

More about the news:

- The decision of the IBBI aligns with the Finance Minister’s budget announcement about a comprehensive review of existing regulations to simplify, ease and reduce the cost of compliance.

- IBBI follows a dual-review mechanism- an annual review with public input and a three-year review based on specific criteria.

- The three-year review process was completed in 2021 by IBBI, and in May of this year, the insolvency regulator sought public comments for the annual review.

- The initiative aims to adapt regulations to changing business dynamics and follows a consultative framework for regulatory improvements in the financial sector.

- Recently, the IBBI has also sought stakeholders' views on implementing Amitabh Kant’s Committee Report on Real-Estate projects to accommodate the complexities of the real estate sector.

Insolvency and Bankruptcy Code (IBC):

- In a growing economy like India, a healthy credit flow and generation of new capital are essential. When a company or business turns insolvent or “sick”, it begins to default on its loans.

- For the credit not to get stuck in the system or turn into bad loans, it is essential that banks or creditors can recover as much as possible and as quickly from the defaulter.

- The business can either get a chance, if still viable, to start afresh with new owners, or its assets can be liquidated or sold off on time.

- This way, fresh credit can be pumped into the system, and the value degeneration of assets can be minimised.

- In 2016, India faced a rising problem of Non-Performing Assets (NPAs) and debt defaults. Existing loan recovery mechanisms, such as SARFAESI, Lok Adalats, and Debt Recovery Tribunals, were considered ineffective.

- In this situation, the Insolvency and Bankruptcy Code, 2016 ( IBC) was introduced to overhaul the corporate distress resolution regime in India and consolidate previously available laws.

Insolvency and Bankruptcy Board of India (IBBI):

- The IBBI was established on 1 October 2016 under the Insolvency and Bankruptcy Code, 2016.

- It is a key pillar of the ecosystem responsible for implementing the Code that consolidates and amends the laws relating to reorganisation and insolvency resolution of corporate persons, partnership firms and individuals.

- It is a unique regulator as it regulates a profession and processes.

- It has regulatory oversight over the Insolvency Professionals, Insolvency Professional Agencies, Insolvency Professional Entities and Information Utilities.

- It has also been designated as the ‘Authority’ under the Companies (Registered Valuers and Valuation Rules), 2017, for regulation and development of the profession of valuers in the country.

Challenges of IBBI:

- Low resolution: Among the 3,400 cases admitted under the IBC in the last six years, half or more than 50% of the cases ended in liquidation, and only 14% could find a proper resolution, which is the first objective.

- Haircut: A haircut is the portion of the debt the lender is willing to forgo or reduce. The Parliamentary Standing Committee on Finance pointed out in 2021 that in the five years of the IBC, creditors on average, had to bear an 80% haircut in more than 70% of the cases.

- For instance, in the resolution of the Videocon Group, creditors bore a haircut of 95.3%.

- Complex regulation process: Some stakeholders have argued that the regulations and procedures under the IBBI framework are overly complex and not user-friendly, especially for smaller businesses.

- Compliance Costs Issues: Complying with the IBBI's regulations often requires substantial costs such as engaging legal experts, legal Fees, high Operational Expenses, etc.

- Delay in resolution process The IBC was amended to make the total timeline for completion a further 330 days. However, in FY22, it took 772 days to resolve cases involving companies that owed more than ₹1,000 crore.

- The average number of days it takes to resolve such cases increased rapidly over the past five years

- Cross-border insolvency challenge: The regulation of cross-border insolvency cases is still evolving. There is a need for better coordination with foreign jurisdictions.

Recommendations of the Parliamentary Standing Committee:

- It recommended that the National Company Law Tribunal (NCLT) should not take more than 30 days after filing to admit the insolvency application and transfer control of the company to a resolution process.

- Citing the more than 50% vacancy in the Tribunal compared to the sanctioned strength, it suggested recruitment in advance based on the projected number of cases.

- It suggested establishing dedicated NCLT benches for IBC cases and extending pre-packs to reduce caseloads.

Conclusion:

The IBBI’s call for suggestions reflects its commitment to continuous improvement and responsiveness to the evolving needs of the financial sector. By seeking public input, it aims to simplify regulatory compliance, making it more efficient and cost-effective. This proactive approach encourages stakeholder participation in shaping the regulatory landscape, fostering a robust and responsive financial ecosystem.

Prelims PYQ

Q. Which of the following statements best describes the term 'Scheme for Sustainable Structuring of Stressed Assets (S4A)', recently seen in the news? (UPSC 2017)

(a) It is a procedure for considering ecological costs of developmental schemes formulated by the Government.

(b) It is a scheme of RBI for reworking the financial structure of big corporate entities facing genuine difficulties.

(c) It is a disinvestment plan of the Government regarding Central Public Sector Undertakings.

(d) It is an important provision in 'The Insolvency and Bankruptcy Code' recently implemented by the Government.