GS2-Polity

In the news

The Cabinet has granted approval for the Uttar Poorva Transformative Industrialization Scheme of 2024.

More about the news

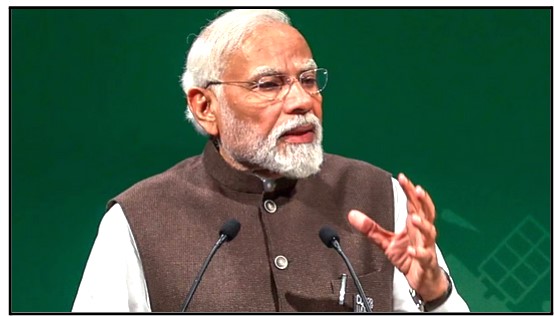

- The Union Cabinet, led by Prime Minister Shri Narendra Modi, has greenlit the Uttar Poorva Transformative Industrialization Scheme, 2024 (UNNATI – 2024), proposed by the Ministry of Commerce and Industry's Department for Promotion of Industry and Internal Trade.

- This scheme, spanning 10 years with an additional 8-year provision for committed liabilities, is allocated a substantial budget of Rs. 10,037 crore.

- It aims to drive industrialization across the Uttar Poorva region, comprising states like Bihar, Jharkhand, Odisha, and others, by focusing on sectors such as manufacturing, agro-processing, and tourism.

- With a strong emphasis on infrastructure development, policy support, and inclusive growth, UNNATI – 2024 seeks to generate employment and unlock the economic potential of these regions, fostering overall development.

About the Scheme

Background

The Government of India has introduced the New Industrial Development Scheme, UNNATI (Uttar Poorva Transformative Industrialization Scheme), 2024 as a Central Sector Scheme aimed at fostering industrial growth and employment generation in the states of the North East Region (NER). The scheme is designed to drive the socio-economic development of the region by generating gainful employment opportunities and fostering productive economic activities in both the manufacturing and service sectors.

Objectives

- Employment Generation: The primary objective of the UNNATI scheme is to create gainful employment opportunities in the NER, thereby catalyzing socio-economic development in the region.

- Industrial Development: The scheme seeks to promote industrial development in the NER by attracting new investments and nurturing existing industries, with a focus on fostering growth in the manufacturing and service sectors.

- Skill Development: Emphasis is placed on skill development initiatives to enhance the employability of the local workforce and ensure their active participation in the industrialization process.

- Sustainable Development: The scheme aims to achieve a balance between industrial growth and environmental conservation by promoting sustainable practices and attracting investments in environmentally friendly sectors.

Expenditure

- Financial outlay: The UNNATI – 2024 scheme entails a substantial financial commitment of Rs. 10,037 crore over 10 years.

- Central Sector Scheme: It will operate as a Central Sector Scheme, indicating significant government backing.

- Part A and Part B: Part A, with Rs. 9,737 crore, focuses on providing incentives, while Part B, allocated Rs. 300 crore, emphasizes implementation and institutional arrangements.

Targets

- Ambitious goals: The scheme aims to attract approximately 2180 applications from investors.

- Job creation: It anticipates generating direct employment for about 83,000 individuals during the scheme period.

- Indirect employment: The scheme is expected to stimulate the creation of a substantial number of indirect job opportunities.

- Socio-economic development: Emphasizes inclusive and sustainable industrialization to drive overall prosperity and progress in Uttar Poorva.

Implementation Strategy

DPIIT will collaborate with states to execute the scheme, with oversight from committees at both national and state levels:-

- Steering Committee: Chaired by the Secretary of DPIIT (SIIT), this committee will provide guidance on scheme interpretation within its allocated financial outlay. It will also issue comprehensive guidelines for execution.

- State Level Committee: Headed by the Chief Secretary of each state, this committee will ensure effective implementation, monitor progress, and maintain transparency and efficiency through checks and balances.

- Secretary Level Committee: Led by the senior Secretary of the state responsible for Industries, this committee will oversee the scheme's implementation. Its duties include recommending registrations and processing claims for incentives.

Positive List

- Renewable Energy: Industries related to renewable energy, such as solar and wind power, are included in the positive list to encourage the adoption of clean and sustainable energy sources.

- EV Charging Stations: With a focus on promoting electric mobility and reducing carbon emissions, the establishment of electric vehicle (EV) charging stations is prioritized under the scheme.

- Agro-based Industries: Industries involved in agro-processing and value addition are encouraged to leverage the region's abundant agricultural resources for economic growth.

Negative List

- Cement Industry: Given the environmental impact associated with cement production, the cement industry is placed on the negative list to prevent adverse effects on the region's ecology.

- Plastics: Industries engaged in the manufacturing and usage of plastics are restricted under the scheme to mitigate the pollution caused by plastic waste and safeguard the environment.

Key Features of the Scheme

- Scheme Period: Effective from the date of Notification until 31.03.2034, with an additional 8 years of committed liabilities.

- Application Period: Industrial units permitted to apply for registration from the date of notification until 31.03.2026.

- Grant of Registration: All registration applications must be processed by 31.03.2027.

- Commencement of Production: All eligible Industrial Units required to commence production or operation within 4 years from the grant of registration.

- District Categorization: Districts classified into two zones—Zone A (Industrially Advanced Districts) & Zone B (Industrially Backward Districts).

- Earmarking of Funds: 60% of Part A outlay earmarked for 8 NE states, with the remaining 40% allocated on a First-In-First-Out (FIFO) basis.

- Inclusion of Micro Industries: Micro industries, as per MSME industry norms, will have building construction and P&M costs included for Capital Investment Incentive.

- Eligibility: All new and expanding industrial units are eligible for the respective incentives outlined in the scheme.

|

The maximum allowable benefits to a single unit from all aspects of the scheme cannot exceed Rs. 250 crore. |

Goods and Services Tax

The Uttar Poorva Transformative Industrialization Scheme, 2024 (UNNATI – 2024) offers a range of incentives to investors, both for establishing new units and expanding existing ones, categorized based on the applicability of Goods and Services Tax (GST).

Here are the key incentives provided under the scheme:-

|

Basis |

GST Applicability |

Non Applicability of GST |

|

Capital Investment Incentive (For both new and expanding units) |

Zone A (GST Applicable): Investors are eligible for a 30% incentive on the value of investment in plant and machinery or construction of buildings and durable physical assets, with a maximum cap of Rs. 5 crore for new and expanding units. Zone B (GST Applicable): A higher incentive of 50% is provided on eligible investments, with a cap of Rs. 7.5 crore. |

Zone A (GST Not Applicable): Investors can avail a 30% incentive on investments up to Rs. 10 crore. Zone B (GST Not Applicable): Similar to Zone A, a 50% incentive is available, but with a cap of Rs. 10 crore. |

|

Central Capital Interest Subvention (For both new and expanding units) |

In Zone A, a 3% interest subvention is provided for a period of 7 years, while in Zone B, it's 5%. |

In Zone A, a 3% interest subvention is provided for a period of 7 years, while in Zone B, it's 5%. |

|

Manufacturing & Services Linked Incentive (MSLI) |

This incentive is exclusively for new units and is linked to the net payment of GST, calculated as GST paid less Input Tax Credit. In Zone A, investors are eligible for 75% of the value of investment in plant and machinery, whereas in Zone B, it's 100%. |

Nil |

Conclusion

The Uttar Poorva Transformative Industrialization Scheme, 2024 (UNNATI – 2024) represents a significant step towards fostering industrial growth and employment generation in the Uttar Poorva region of India. With a substantial budget allocation and a focus on key sectors such as manufacturing, agro-processing, and tourism, the scheme aims to drive inclusive and sustainable development. Through robust implementation strategies, clear eligibility criteria, and a range of incentives, UNNATI – 2024 seeks to attract investments, create employment opportunities, and unlock the economic potential of the region. By promoting infrastructure development, policy support, and environmental sustainability, the scheme is poised to catalyze overall prosperity and progress in Uttar Poorva.