Polity+Economy(CA)

Why in the news?

Recently, the Mines and Minerals (Development and Regulation) Amendment Bill, 2023 has been approved by the Rajya Sabha.

Background:

The Mines and Minerals (Development and Regulation) Act of 1957 underwent several amendments to address evolving concerns and enhance the mineral sector. In 2015, amendments introduced auction-based mineral concession allocation for transparency, established the District Mineral Foundation (DMF) for community welfare, initiated the National Mineral Exploration Trust (NMET) for exploration promotion, and imposed stricter penalties for illegal mining.

Further amendments occurred in 2016, 2020, and 2021, focusing on specific issues and implementing reforms such as eliminating the distinction between captive and merchant mines. Despite these changes, more reforms were deemed necessary, particularly for boosting exploration and mining of Critical Minerals crucial for economic development and national security.

The critical minerals' inadequate availability or concentration in a few regions posed potential supply chain vulnerabilities and risks of disruption. Given India's commitment to energy transition and achieving Net-Zero emissions by 2070, critical minerals gained prominence. The Mines and Minerals (Development and Regulation) Amendment Bill, 2023, addresses these concerns and seeks to further reform the mineral sector.

Key Features of the Amendment

|

Key Provisions |

MMDR Act, 1957 |

MMDR Act, 2023 |

|

Exploration of Atomic Minerals |

Restricted to State agencies |

Private sector granted access to six minerals, including lithium, beryllium, niobium, titanium, tantalum, and zirconium. |

|

Powers for Mining Critical Minerals |

Limited to State agencies exclusively |

Central government empowered to conduct auctions for mining leases of critical minerals like gold, silver, copper, zinc, lead, nickel, etc |

|

Auction for Exploration License |

No specific provisions are outlined. |

Exploration licenses are granted through competitive bidding under the supervision of the state government. Central government to establish detailed auction processes, terms, conditions, and parameters through rules. |

|

Maximum Area for Activities |

Prospecting: 25 sq km; Reconnaissance: 5,000 sq km |

Exploration license permits activities in an area of up to 1,000 sq km. After the initial three years, the licensee can retain up to 25% of the originally authorized area. |

|

Incentives for Exploration License |

Not specified |

Upon proven resources after exploration, the state government must conduct an auction for a mining lease within six months. The exploration licensee receives a share in the auction value for the prospected mineral. |

What was the need to amend the MMDR Act 1957?

- To boost private sector involvement in exploration processes, aligning India with the practices of developed nations. The new Bill aims to leverage the expertise and financial capabilities of the private sector to enhance exploration activities.

- For instance, countries like Australia have private mining firms known as junior explorers, which play a crucial role in exploration by taking risks and utilizing their expertise and limited finances to discover potential mines. This approach accelerates the exploration pace and contributes to the overall development of the mining sector.

However, there are concerns with the proposals in the Bill:

- Lack of Clarity: Explorers may face uncertainty about their revenue, as the auction premium's amount becomes known only upon the successful auction and operation of a mine.

- Revenue Generation Challenges for Private Exploration Companies: Private companies holding exploration licenses would primarily generate revenue through a share of the premium paid by the miner. However, this revenue would only materialize after a successfully discovered mine is auctioned and becomes operational. This delay poses challenges for the financial sustainability of private exploration ventures.

Mining Sector in India

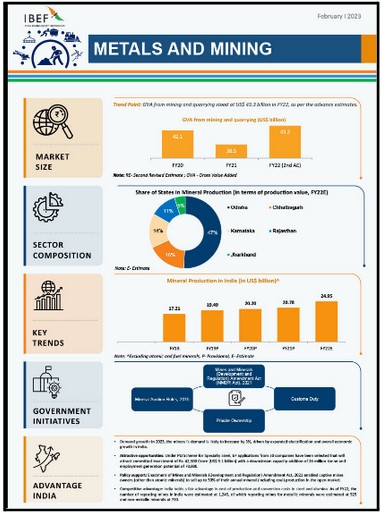

- Total mines: As of FY22, India had an estimated 1,425 reporting mines. Among these, 525 were dedicated to metallic minerals, and 720 were focused on non-metallic minerals.

- Mining GDP: Data from the Ministry of Statistics and Programme Implementation (MOSPI) revealed a growth in India's mining GDP. It rose from Rs. 739.90 billion (US$ 8.98 billion) in the fourth quarter of 2020 to Rs. 913.03 billion (US$ 11.09 billion) in the first quarter of 2021.

- Production of Various Minerals:

- Iron Ore:

- India's iron ore production reached 250 MT in FY22, marking a notable 23% increase compared to the 204 MT recorded in FY21.

- Globally, India ranks fourth in terms of iron ore production.

- Coal:

- India witnessed a significant growth in overall coal production, reaching 893.08 MT in FY23, up from 728.72 MT in FY19, showcasing a growth of about 22.6%.

- Steel:

- Crude steel production in India reached 71.3 MT in FY23.

Scenario of Mining Sector in India:

- Role in Economy:

- The mining industry is a pivotal force in India's economy, serving as the foundation for the manufacturing and infrastructure sectors.

- According to the Ministry of Mines, the total value of mineral production (excluding atomic and fuel minerals) during 2021-22 reached Rs 2,11,857 crore.

- Scope

- India holds global prominence, ranking 4th in iron ore production and securing the 2nd position as the world's largest coal producer in 2021.

- The combined annual aluminum production (primary and secondary) in India reached 4.1 MT in FY21, establishing the country as the 2nd largest in the world.

- Cost Advantage and Export Opportunities:

- India maintains a competitive edge in production and conversion costs for steel and alumina.

- The strategic location of India opens up export opportunities, particularly to rapidly developing Asian markets.

Government initiatives in the sector:

- National Mineral Exploration Policy:

The goal of this policy is to share top-notch geoscientific data with the public. The aim is to provide high-quality information about minerals that everyone can access.

- Mines and Mineral Development and Regulation Act (MMDR):

This act was changed in 2015 and 2016 to allocate mineral blocks more open and competitively. Now, mineral blocks are allocated through auctions, ensuring a fair and transparent process.

- Mineral Conservation and Development (Amendment) Rules 2021:

These rules focus on preserving minerals, promoting systematic and scientific mining, and developing minerals in a way that protects the environment. It underscores the importance of responsible mining practices.

- Production Linked Scheme:

In 2022, the Cabinet approved the PLI Scheme to boost the domestic production of specialty steel. They allocated Rs. 6,322 crore (US$ 762.4 million) for this initiative, aiming to strengthen the country's specialty steel production.

- District Mineral Foundation (DMF):

Established in 622 districts across 23 states, the DMF has collected a total of Rs. 71,128.71 Crore (US$ 8.5 billion) by October 2022. At least 60 percent of these funds are dedicated to critical areas like providing clean drinking water, preserving the environment, controlling pollution, and supporting healthcare and education initiatives.

Challenges associated with the Mining Sector:

- Lack of Advanced Technology:

The absence of advanced and eco-sensitive technology has hindered the mining of resources in environmentally delicate areas. For instance, the Jharia coal block, rich in coking coal crucial for the steel industry, remains untapped due to an ongoing fire.

- Red Tapism:

Cumbersome bureaucratic processes and extended clearance times for licenses, along with restrictions like captive use, impede mining productivity. In India, securing a mining lease takes over four years, in contrast to the quicker timelines in major mining countries like Brazil, Chile, the US, and Canada.

- Global Market Fluctuations:

The mining sector is heavily influenced by global market demand and price fluctuations, making it vulnerable to economic shifts and geopolitical events.

- Infrastructure Challenges:

Numerous mining areas face a lack of basic infrastructure, including electricity, water supply, and healthcare. This deficiency adversely affects the quality of life for local communities.

- Skill Shortages:

The mining sector grapples with a shortage of skilled workers, impacting the efficiency and safety of mining operations.

- Social Issues:

Mining regions often encounter social problems such as labor disputes, substandard working conditions, and conflicts with local communities regarding resource access and benefits. Addressing these social concerns is essential for sustainable and responsible mining practices.

Way Forward:

- Addressing the Skilled Labour Gap:

To tackle the shortage of skilled labor in mining, it is crucial to enhance educational capacities. This can be achieved through partnerships between educational institutions and industry, involving the HRD ministry or the National Skill Development Council.

- Adherence to Laws:

Mining companies should recognize the economic value of resources and avoid unnecessary wastage of valuable minerals. Strict adherence to rules, from the exploration stage to mine closure, is essential for responsible and sustainable mining.

- Consistent Policy:

To restore investor confidence, the government must ensure that policies related to allotment, taxation, and general administration remain consistent. Avoiding retrospective changes is key for a stable and predictable investment environment.

- Collaboration with Stakeholders:

Encouraging collaboration among government bodies, industry players, academic institutions, and local communities is vital. This approach ensures holistic development and promotes responsible mining practices.

- Community Engagement:

Prioritizing the involvement of local communities is essential. This involves providing fair compensation, generating employment opportunities, and promoting sustainable development in mining regions.

- Adoption of Sustainable Practices:

Highlighting environmentally friendly mining practices is crucial. Emphasizing minimal ecological impact and implementing proper land reclamation after mining activities contribute to sustainable and responsible mining practices.

Conclusion

Fostering a balanced and sustainable mining sector requires a multi-faceted approach. From addressing skill gaps and adhering to regulations to promoting consistent policies and community engagement, collaborative efforts are crucial. By adopting environmentally friendly practices and prioritizing responsible mining, we pave the way for a more inclusive and sustainable future in the mining industry. This concerted effort, involving stakeholders at every level, is key to unlocking the full potential of this vital sector while ensuring long-term benefits for both the industry and the communities it serves.