Highlights of budget

The nodal body in charge of creating the budget is the department of economic affairs' budget division in the finance ministry.

Vision for Amrit Kaal-

- Economic empowerment of women

- Deendayal Antyodaya yojana- national rural livelihood mission

- PM Vishwakarma Kaushal Samman (PM VIKAS)

- Tourism

- 50 new tourist hubs.

- Green growth

- Green energy

- Green farming

- Green mobility

- Efficient use of energy across various sectors.

Priorities under budget - Seven (Saptarishi)-

Allocation to different ministries under budget-

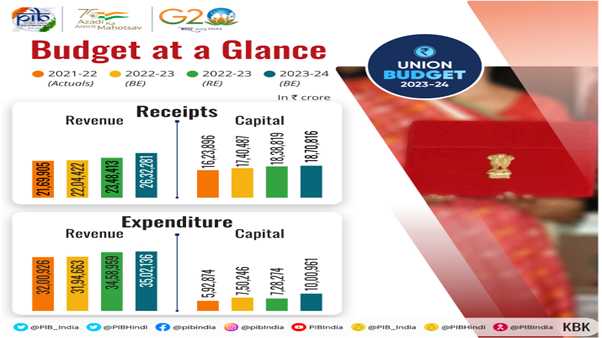

Capital expenditure-

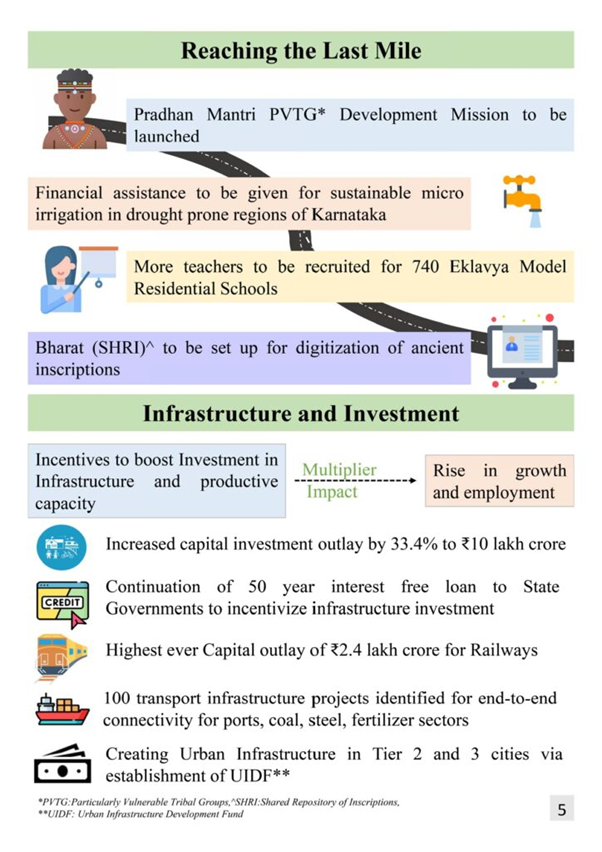

- There has been a big jump in the government's capital expenditure; at Rs 10 lakh crore, the centre's capex target for 2023-24 is 33% higher than the budget for 2022–2023, an estimate of Rs. 7.5 lakh crore.

(Year) (In rs. crore)

- 2023-2024- 10 lakh

- 2022-2023- 7.5 lakh

- 2021-2022- 5.4 lakh

- 2020-2021- 4.39 lakh

Fiscal deficit-

|

|

|

Trends with respect to receipt and expenditure-

|

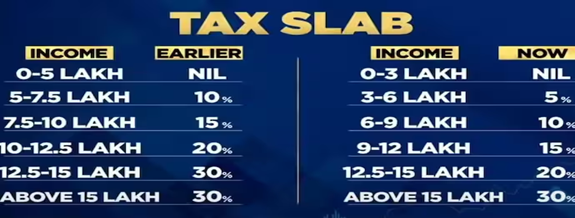

Personal tax income-

|

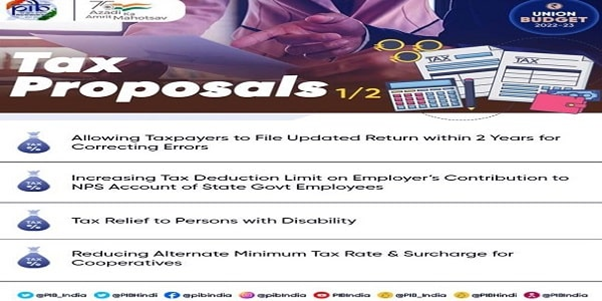

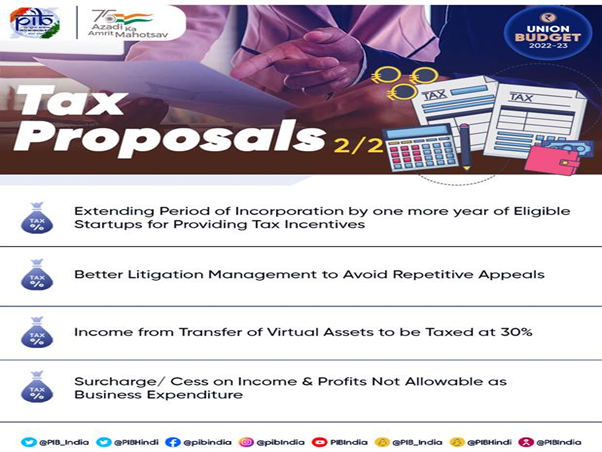

Tax proposals-

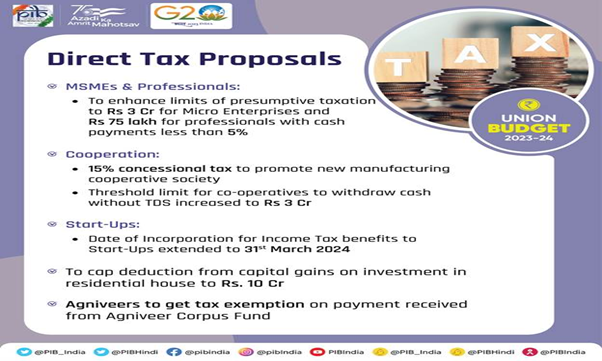

Direct tax proposals-

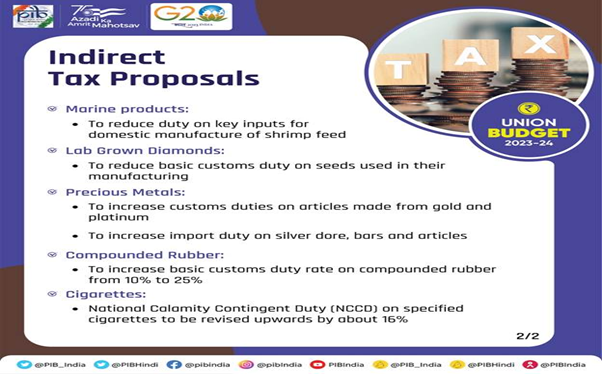

Indirect tax proposal-

India- 5th largest economy

- At Rs. 1.97 lakhs, the per capita income has more than doubled.

- In the last nine years, the Indian economy has increased from the 10th to the 5th largest in the world.

G20 Presidency-

- As per the finance minister Nirmala Sitharaman India's G20 presidency has given us unique opportunities to strengthen India's role in the world economic order.

Agriculture-

- Supply of foodgrains-

- Supply of free foodgrains to over 80 crore persons for 28 months.

- We are implementing a scheme to supply foodgrains from January 1, 2023, to all Antyodaya and priority households for the next year and will spend Rs 2 lakh crore.

- The global hub for millets-

- India is the largest producer and second largest exporter of millets, and the continued focus on domestic production, consumption, and export potential will earn us greenbacks and add to India's soft power.

- The Indian Institute of millet research will be supported as a centre of excellence.

- Agri-tech startups-

- The government announced digital public infrastructure for agriculture, which will enable farmer-centric services relevant to crop protection, which is a shot in the arm for agri- tech startups in the country.

- Agritech businesses defied the 2022 financing slump and raised significant sums from investors, although India still needs to produce an agritech unicorn.

- Agri-credit target-

- The Agri credit target will be increased to rs 20 lakh crore with a focus on animal husbandry, dairy, and fisheries.

- The government has also initiated computerization for 63,000 primary agriculture credit societies with an investment of rs 2516 crore.

- Clean plant program-

- The government will launch the Atmanirbahr clean plant program to improve the availability of disease-free quality planting material.

- For high-value horticulture crops an outlay of rs 2200 crore.

- Natural farming-

- Over the next 3 years, one crore farmers will get assistance to adopt natural farming.

- 10,000 bio-input resource centers will be set up.

Allied sector-

- Push for fisheries-

- The government will launch a sub-scheme under the PM Matsya Sampada yojana with an outlay of Rs 6000 crore to further enable those involved in fisheries.

- A package of support for traditional craftsmen and craftspeople called the PM Vishwakarma Kaushal Samman has been designed to help them expand the scope and quality of their product lines while integrating with the MSME value chain.

Environment and Green Growth-

- The finance minister said that Green growth would be one of the priorities of the budget.

- Implementation of various programs related to green growth will help reduce carbon intensity and create jobs across various economic sectors.

- PM PRANAM to be launched- will incentivize states/UTs to promote the usage of alternative fertilizers.

- 500 new “waste-to-wealth plants' '- to be established under the GOBARdhani scheme for promoting a circular economy.

- Green credit program- to be notified under EPA to incentivize sustainable actions.

- Green credit program: According to FM, the Environment Protection Act will be notified of a green credit program.

- Sustainable ecosystem development-

- "Mangrove Initiative for Shoreline Habitats & Tangible Incomes," (MISHTI) is to be taken up for mangrove plantations along the coastline.

- It is planned to adopt Amrit Dharohar to make the best use of wetlands.

Green hydrogen mission-

- The recently launched national green hydrogen program with an outlay of Rs 19,700 crore will facilitate the transition of the economy to low-carbon intensity and reduce dependency on fossil fuel imports.

- Our target is to reach an annual production of 5 MMT by 2030.

- This budget provides for Rs 35000 crore capital investment towards energy transition and net zero objective and energy security by the ministry of petroleum and natural gas.

- Other initiatives-

- Setting up 10,000 bio inputs resource centers to adopt natural farming.

- Promotion of battery energy storage systems

- Promotion of coastal shipping for energy-efficient transportation.

- Funds to be allocated for replacing old polluting vehicles.

|

Health-

|

|

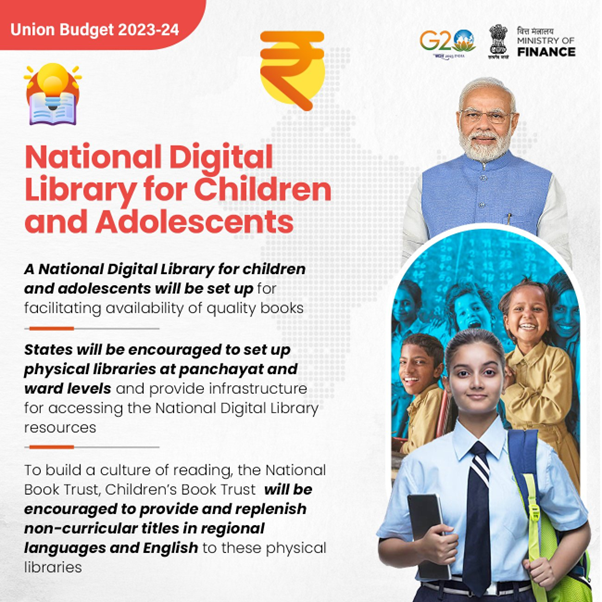

EDUCATION

|

Empowerment-

- Technology-driven society-

- The vision for Amrit Kaal includes a technology-driven and knowledge-based economy, with strong public finances and a robust financial sector.

- To achieve this Janbhagidari through ‘sabka sath sabka prayaas’ is essential.

- PM Primitive Vulnerable Tribal Groups Mission-

- To improve the socio-economic condition of the particularly vulnerable tribal groups, the PMPVTG Development Mission will be launched, to saturate PVTG habitations with basic facilities.

- Rs 15000 crore to be made available to implement schemes in the next 3 years.

Railways- A capital outlay of Rs. 2.40 lakh crore. This is nine times the outlay made in 2013.

Ease of doing business

- To enhance the ease of doing business, more than 39,000 compliances have been reduced, and over 3400 legal provisions have been decriminalized.

- For the business establishments required to have a permanent account number, the PAN will be used as a common identifier for all digital systems of specified government agencies.

Lab-grown diamonds-

- To encourage production and sales of lab-grown diamonds (lab-grown diamonds are artificially produced but have similar properties as natural diamonds and are cost-effective).

- Government will provide research and development grant in the lab-grown diamond area as well as consider custom, and duty reduction on key raw materials (law-grown seeds).

- Lab-grown diamonds have huge potential in both domestic and export markets

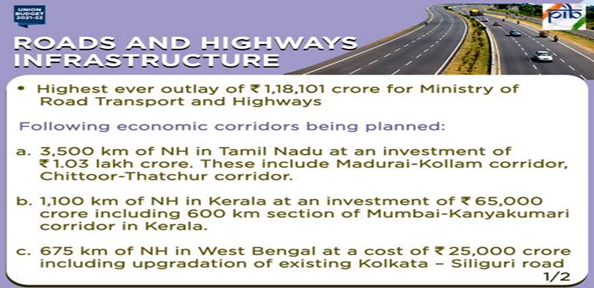

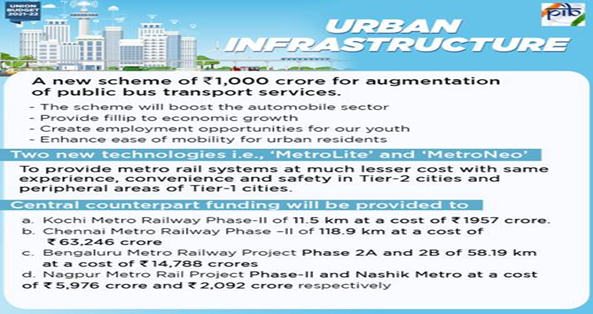

Transport infrastructure projects-

|

Skill development- National apprenticeship promotion program- to provide stipend support to 47 lakh youths in 3 years.

|

|

Push for tourism-

|

Compressed biogas mandate-

- The government plans to introduce a 5% compressed biogas mandate for all entities marketing natural gas in india.

- This may mean that companies marketing natural gas in india will have to market compressed biogas, or CBG, to the extent of 5% of their volumes.

- The government has been pushing for increased production of CBG and its blending with natural gas, particularly in the transportation segment that uses compressed natural gas, or CNG, as a fuel.

|

IT sector-

|

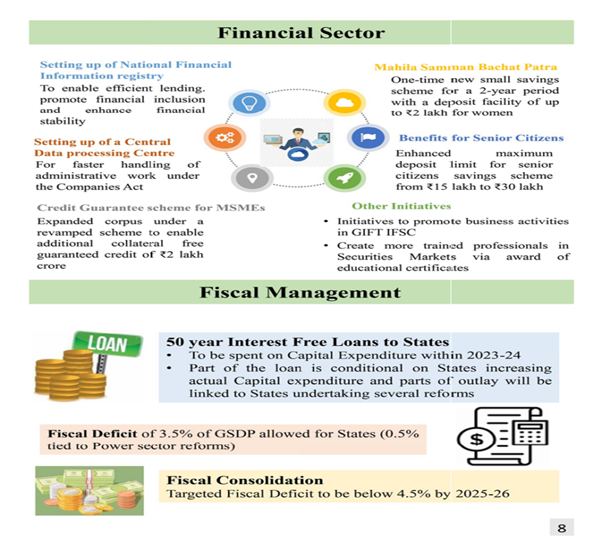

Financial sector-

- National financial information registry- The government will set up a national financial information registry to serve as a central repository of financial and ancillary information.

- Revamped credit guarantee scheme for MSME-

- Revamped credit guarantee scheme for MSME will take effect from April 1 2023 with the infusion of Rs. 9000 crores into the corpus.

- This will enable an additional collateral-free credit guarantee of Rs. 2 lakh crore rupees, which will enable to lower cost of credit by 1%.