Relevance: GS III

Context:

The government has decided to allow domestic companies to list overseas to help them access capital from the world markets.

GS Paper III

More details on news

- The corporate affairs ministry has notified the relevant section under the companies law.

- Section 5 of the Companies (Amendment) Act, 2020 allows certain classes of public companies to list their securities on permitted stock exchanges in permissible foreign jurisdictions or such other jurisdictions, as may be prescribed.

- Currently, overseas listings by local listed entities are carried out through American Depository Receipts (ADRs) and Global Depository Receipts (GDRs).

American depositary receipt (ADR)

- American Depositary Receipts (ADR) are negotiable security instruments that are issued by a US bank that represent a specific number of shares in a foreign company that is traded in US financial markets.

- ADRs pay dividends in US dollars and trade like regular shares of stock.

- Companies can purchase stocks of foreign companies in bulk and reissue them on the US market.

- ADRs are listed on the NYSE, NASDAQ, and AMEX and can be sold over-the-counter.

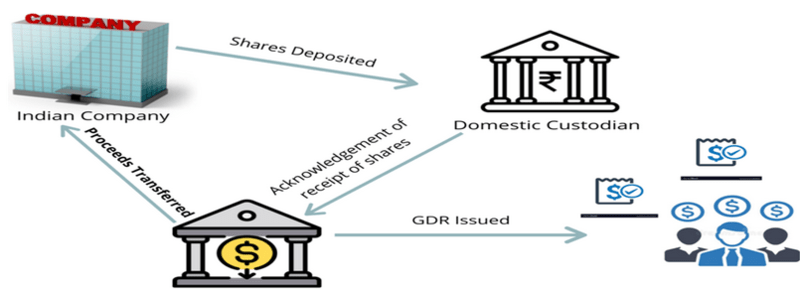

Global Depository Receipt (GDR)

- A Global Depository Receipt (GDR) is a depositary receipt issued by a depository bank that purchases shares of foreign companies.

- Indian companies can get their shares listed on foreign exchanges through GDRs.

- A GDR is a foreign currency-denominated negotiable instrument.

- Companies can trade shares on international exchanges except for the US through a GDR.

Significance of direct listing of Indian firms on foreign stock exchanges:

- Capital access: The decision of the government to allow domestic companies to list overseas will help them access capital from the world markets.

- Capital pool and company visibility: The primary incentive for a company to list overseas is the broader capital pool and a diversified investor base. Such a move enhances a company's visibility and standing.

- Better valuations: Given India’s stature as a startup hub, foreign listings can offer better valuations for tech enterprises, potentially invigorating India’s startup sector.

- Elimination of intermediary: In direct listings, companies can join foreign stock exchanges without intermediaries. This approach eliminates the middlemen, reduces transaction costs, and promotes transparency.

Regulatory and governance issues:

- Direct listing on foreign stock exchanges is a complex issue with a number of potential implications. For example regulatory issues.

- The dual listing in India and foreign stock exchange can create challenges in terms of adhering to the different regulations and reporting standards of each jurisdiction. For example, the real value of the entity.

- Indian regulators may have less oversight on companies listed abroad, potentially leaving Indian investors with fewer protections. For example, security issues and trust issues.

- The government may need to provide Indian investors with access to foreign courts and tribunals for protection. It may also clarify the tax implications of direct listings to avoid uncertainty. For example, we need to improve tax structures.

Way forward:

- Need of a dedicated regulatory body for more transparency.

- Collaboration with foreign exchanges for more accountability.

- Access to foreign courts and tribunals for smooth process of transactions.

- We need better corporate governance for the share market .