GS Paper II

News Excerpt:

The government ordered the blocking of 22 betting apps and websites, including Mahadev Book and Reddyannaprestopro.

About:

- The Enforcement Directorate (ED) is investigating the Mahadev Book Online Betting App syndicate and the promoters of this betting syndicate.

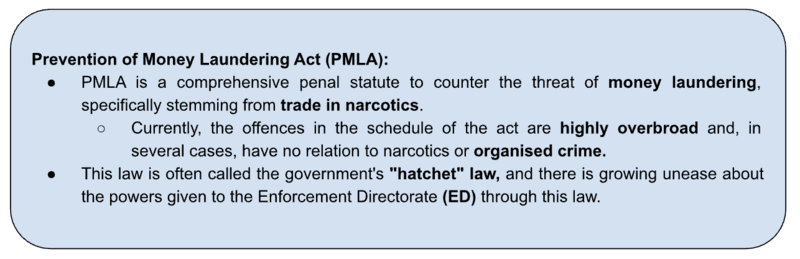

- The owners of Mahadev Book have been arrested under the Prevention of Money Laundering Act (PMLA).

- The power to recommend shutting down the website/app under Section 69A IT Act lies with the Central government and the state government.

Online gambling:

- Engaging in gambling activities via the Internet is referred to as online gambling. This entails putting money or prizes at risk by making bets on different games and events.

- Online poker, lotteries, sports betting, and casino games, including slots, blackjack, and roulette, are a few of the most popular forms of gambling.

- Instead of using cash to play online gambling games on different devices, players may utilise digital currency.

- With the Asia-Pacific area being the largest market, the worldwide online gambling industry was estimated to be worth USD 63.53 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030.

Online Gaming vs Online Gambling:

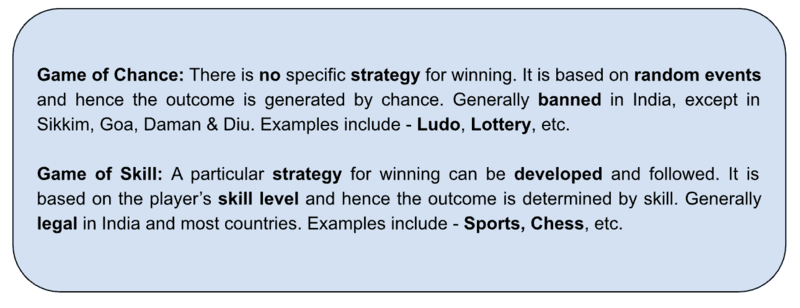

- The primary differentiation between the two is the “presence of skill”. If the activity requires “skill”, it is categorised as online gaming. If the activity does not require “skill”, it falls into the online gambling category.

- Therefore, according to the law, gaming activity requires “skill”, while gambling activity is based on “chance”.

Present legal framework regarding gambling:

Central framework:

- The Public Gambling Act 1867 and the Information Technology Act 2000 govern online gambling and gaming activities in India.

- Section 66 of the IT Act deals with computer-related crimes.

- Sections 67, 67A, and 67B deal with the discretion to make laws on the subject of online gaming, as gambling and betting are mentioned in the state list of the constitution.

- Section 69A: It empowers the government to block information from public access under specific conditions -

- Interest of the sovereignty and integrity of India,

- defence of India,

- security of the State

- friendly relations with foreign States

- public order

- for preventing incitement to the commission of any cognisable offence relating to the above.

State-specific framework:

Gambling and betting are mentioned in the State list of the 7th schedule -

- The Assam Game and Betting Act of 1970 fails to distinguish between the game of skill and chance.

- The Sikkim Online Gaming Act of 2008 regulates the gambling and gaming industry in Sikkim, prohibiting the locals from getting into betting games. Sikkim has a licensing regime for games of skill and chance.

- In Nagaland, the Prohibition of Gaming and Promotion and Regulation of Online Games of Skill Rules 2016 inspects, regulates and keeps tabs on skill-based games like sudoku, car racing, solitaire, etc. Nagaland has a licensing authority for online games categorised under mere skill.

- In 2020, Telangana and Andhra Pradesh imposed a ban on any online gambling or real-money gaming activities.

- Karnataka has recently amended its gaming laws to restrict people from playing online games of chance, i.e., gambling, betting, and wagering.

- Tamil Nadu passed the “Tamil Nadu Prohibition of Online Gambling and Regulation of Online Games Act, 2022” to prohibit online gambling and regulate online games.

Recent developments:

- In the 50th GST Council meeting, it applied a 28% tax rate on the full value of online gaming, casinos, and horse-trading.

- The Ministry of Electronics and IT (MeitY) released the Rules for Online Gaming. The rules have been introduced as an amendment to the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021. These regulations are applied to real-money games and to the free game of skills, which includes online fantasy sports contests, e-sports, card games, etc.

Judicial Interpretations:

- Varun Gumber v. Union Territory of Chandigarh (2017): The Punjab and Haryana High Court held that “the element of skill” is the predominant outcome of Dream 11 games, as it is a fantasy sport. Therefore, it is exempted from the Provision of Gambling Act 1867 (PGA).

- Gurdeep Singh Sachar v. Union of India and Others (2019): Online fantasy sports have been classified as games of skill.

- Galactus Funware Technology v. State of Karnataka (2022): The Karnataka High Court held that the amendment in Karnataka Police (Amendment) Act 2021, which criminalises betting, wagering, and gambling, whether by playing a game of skill or a game of chance, is ultra vires the fundamental right to equality under Article 14 as it prohibits games of skill and chance where stakes are involved, despite differences established between the two. The Court further stated that banning all games involving monetary stakes in the public interest has no data to support the arguments.

Challenges:

- Absence of regulatory oversight and clear legislation makes the industry - unregulated and its users - vulnerable, and responsible practices are not followed.

- For example, the syndicate nabbed by ED could have been using the money and cryptocurrencies for hawala financing, terrorist financing, drug trafficking or other organised crimes.

- States have their form of localised regulations, which have resulted in the fragmentation of the online gambling industry.

- Social issues like gambling addiction and associated consequences put the industry in a bad light, impeding its chances to grow.

- Addiction among children is causing them to take/steal money from their parents.

- The heavy tax burden on the emerging gaming sector can have significant and multifaceted impacts.

- A 28% tax rate may discourage FDI inflows into the sector, leading to reduced investments, limited access to international expertise, and restricted opportunities for technology transfer.

- A vast majority of gaming and gambling companies fall within the MSME sector.

- With an increase in GST liability of over 400%, many entrepreneurs and start-ups would be disproportionately impacted and may go out of business.

Way forward:

- Regulatory clarity: The government can shift the subject of betting and gambling to the Union List and make umbrella legislation to regulate the industry. The critical elements of the governance framework should focus on:

- classification of online games;

- identification of skill versus chance dominance by using a data-driven approach;

- monetary risk and/or betting aspects involved in the game, and

- prevention and dealing with the problem of game addiction.

- Re-evaluate the Tax Rate: The tax rate imposed should be reviewed and reduced to a more competitive level. A lower tax rate would incentivise investment, attract foreign capital, and encourage the growth of the industry.

- This can create a favourable environment for startups and stimulate economic activity within the sector.

- Support Skill Development and Infrastructure: By focusing on training and upskilling programs, the government can nurture a skilled workforce capable of meeting the industry's demands.

- Addiction issues can be addressed through measures such as in-game warnings, ratings based on addictive potential, and counselling services for addicted individuals.

- Introducing built-in fatigue systems that alert users if they play beyond a certain number of hours should be considered by gaming operators.