The government wants WhatsApp to disclose the source ID of the deepfakes

GS Paper II

Context:

On account of rising artificial intelligence (AI)-led deepfakes on WhatsApp, the union government is looking to invoke Information Technology (IT) Rules, 2021 that would require WhatsApp to share details about the first originator of a message.

Background:

- Last month, the Tripura High Court stayed an order by a trial court which had directed WhatsApp to disclose the first originator of a chat containing a fake resignation letter of CM Manik Saha. The High Court held that the trial court did not specifically deal with the issue regarding the extent of the threat to “public order” as prescribed under Rule 4 (2), before asking WhatsApp to reveal the first originator of the message.

- WhatsApp and Facebook had challenged the IT Rules 2021 in the Delhi High Court, saying it will “severely undermine” their users' privacy. The case is currently sub judice.

About:

Deepfake:

- It is an image or video of a person in which the face or body has been digitally altered so that he or she appears to be someone else, typically used to spread false information.

- These are created by machine learning models, which use neural networks to manipulate images and videos.

Arguments by the government:

- As the country heads to Lok Sabha elections in 2024, it can cause harm to electoral integrity in India and influence the public discourse.

- The traceability provision needs to be invoked to create some accountability and stop the practice of anonymous use of the platforms.

- This would be the first time that the union government will directly send an Internet platform an order under Section 4 (2) of the IT Rules, 2021.

Concerns raised by WhatsApp:

- It has called it a threat to its end-to-end encryption system which keeps communications private from even the company itself. The privacy rights of the users will be affected.

- It has also questioned the technical feasibility of enforcing the measure, as it will break its security systems.

- Enforcement of such a measure can lead to mass surveillance.

What does the IT Rules say:

- Online messaging companies are required to disclose the identity of a person who first sends a particular message on their platform. The order, also known as traceability, can be passed either by a court or the government.

- The orders can only be issued for the purposes of prevention, detection, investigation, prosecution, or punishment of an offence related to national security issues, public order, or friendly relations with a foreign government.

- In cases where other “less intrusive means” are available to identify the originator of the information, the traceability order should not be issued.

Challenges posed by Deepfake:

- It exclusively targets women; pornographic deepfakes can threaten, intimidate, and inflict psychological harm. It reduces women to sexual objects causing emotional distress, financial loss and collateral consequences like job loss.

- It depicts a person as indulging in antisocial behaviours and saying vile things that they never did.

- It causes short-term and long-term social harm and accelerates the already declining trust in traditional media.

- It acts as a powerful tool for a malicious nation-state to undermine public safety and create uncertainty and chaos in the target country.

- Deepfakes are also used by non-state actors, such as insurgent groups and terrorist organisations, to show their adversaries as making inflammatory speeches or engaging in provocative actions to stir anti-state sentiments among people.

Global regulations:

- China had rolled out regulations in earlier 2023, to restrict the use of deep synthesis technology through which deepfakes are created. The regulations require deep synthesis service providers and users to ensure that any doctored content using the technology is explicitly labelled and can be traced back to its source.

- The European Union in 2018 bought a Code of Practice to stop the spread of disinformation through deepfakes. The tech companies - Google, Meta, and Twitter can face fines of as much as 6% of their annual global turnover if they are unable to take measures to counter deepfakes and fake accounts.

- S. introduced the bipartisan Deepfake Task Force Act to assist the Department of Homeland Security (DHS) in countering deepfake technology.

- In India, there are no legal rules against using deepfake technology. However other laws can be addressed for misusing the tech, including copyright violation, defamation, and cyber felonies.

Way forward:

- Deepfakes have proved to be a nuisance, they should be regulated within the framework of law and not by any arbitrary actions on the part of the government. There is a need to develop legislative solutions to counter the creation and distribution of malicious deepfakes. For this meaningful and collaborative discussion with the technology industry and civil society should be held.

- Media literacy for consumers is the most effective tool to combat disinformation and deepfakes. Media literacy efforts must be enhanced to cultivate a discerning public.

PYQ’s

Q1. With the present state of development, Artificial Intelligence can effectively do which of the following? UPSC-2016

1) Bring down electricity consumption in industrial units

2) Create meaningful short stories and songs

3) Disease diagnosis

4) Text-to-Speech Conversion

5) Wireless transmission of electrical energy

Select the correct answer using the code given below:

(a) 1, 2, 3 and 5 only

(b) 1, 3 and 4 only

(c) 2, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Q2. Impact of digital technology as a reliable source of input for rational decision making is a debatable issue. Critically evaluate with suitable example. UPSC 2021

Operation Ajay

- It is a repatriation operation to bring back around 18,000 Indian citizens from Israel.

- It was launched after the attack on Israel by the terrorist group Hamas.

- A large number of Indian traders, IT professionals, domestic workers, and caregivers work in Israel.

- Special chartered flights are bringing bring back the Indians from Israel.

- India has set up a 24/7 control room in New Delhi, Tel Aviv, and Ramallah.

Indian Ocean Rim Association – A key bloc for India

GS Paper – II

Context:

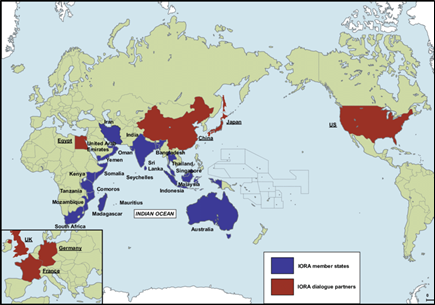

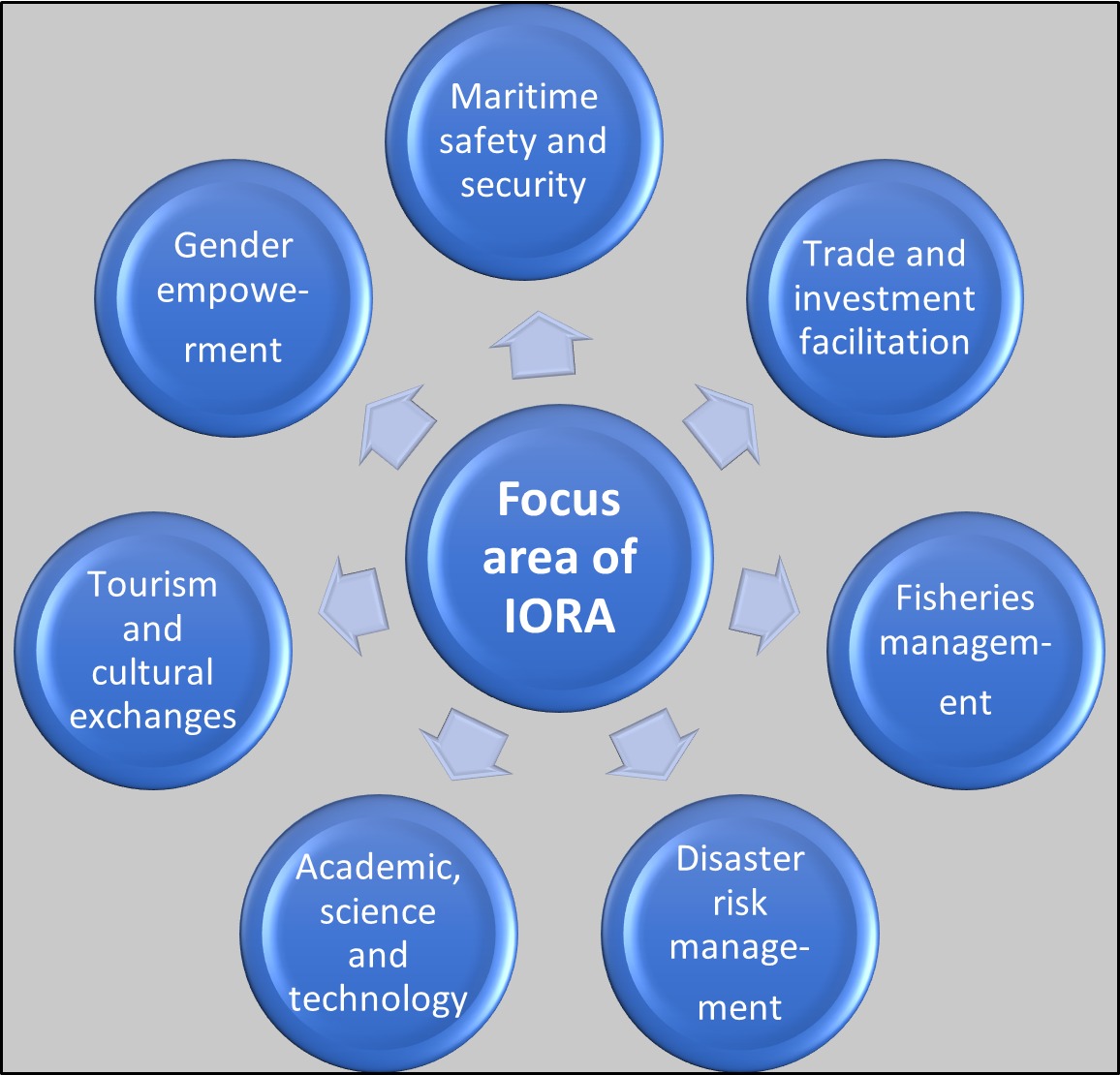

Indian Ocean Rim Association’s (IORA) Council of Ministers (COM) held recently in Colombo, that was attended by foreign ministers and senior officials of the 23-nation grouping of countries.

Background:

- The Indian Ocean Rim Association (IORA) is an inter-governmental organisation formed in 1997 in Mauritius to foster regional economic cooperation.

- IORA includes 23 countries from Africa, West Asia, South Asia, South East Asia, Australia and littoral states situated in and around the Indian Ocean.

- The grouping, whose apex body is the Council of Foreign Ministers that meets once a year, moves by rotation through members every two years.

- Sri Lanka took charge as Chair this year from Bangladesh, and India is Vice-Chair, meaning that the troika of IORA is within the South Asian region.

- IORA became an observer to the UN General Assembly and the African Union in 2015.

- Decisions made within IORA are reached by consensus and commitments are undertaken on a voluntary basis.

- The IORA Secretariat is based in Mauritius. It is headed by a fixed-term Secretary-General. Its genesis comes from a speech Nelson Mandela gave in Delhi in 1995.

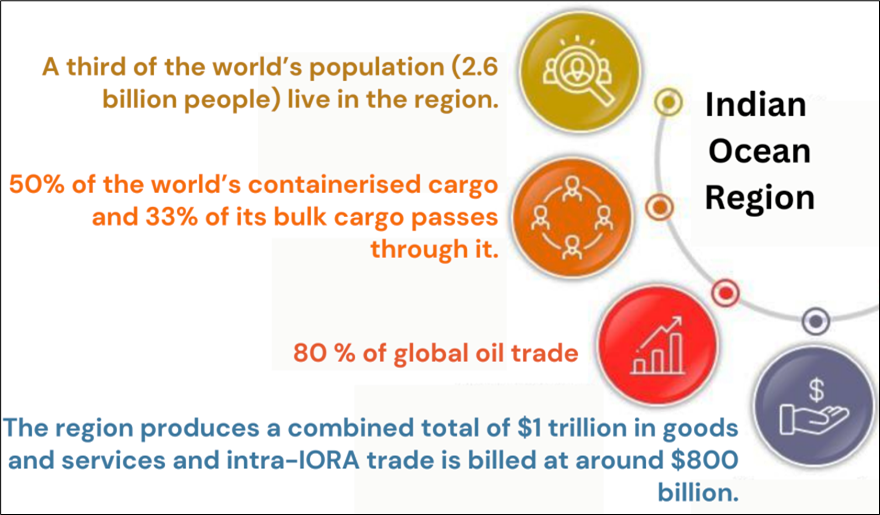

Significance of the Indian Ocean region:

- Geopolitical Security:

- The Indian Ocean Region is a region facing threats from terrorism, piracy, and maritime security challenges.

- The increased military activity in recent years, with major powers like for example, China actively trying to rope in India’s neighbours with groupings like the Belt and Road Initiative (BRI), China-Indian Ocean Region Forum on Development Cooperation, China-South Asian Countries Poverty Alleviation and Cooperative Development Centre, which exclude India.

- Geographical Significance:

- There are the vital global shipping routes and choke points in the Indian Ocean joining: (1) Strait of Hormuz (2) Strait of Malacca (3) Bab-el-Mandeb (4) The Sunda and Lombok Straits (5) Mozambique Channel (6) Ten Degree and Six Degree Channels.

- Environmental Significance:

- Rich Resource Base: The Indian Ocean holds 16.8% of the world’s proven oil reserves and 27.9% of proven natural gas reserves.

- Indian Ocean economies accounted for 35.5% of global iron production, 60 per cent of uranium, 40 per cent of gold and 80 per cent of all diamond deposits.

- The region is also responsible for 28% of global fish capture in 2016, and there has been a continuous increase in fish capture in the region since the 1950s.

- Raw material in IOR: These include lithium, beryllium, zirconium, thorium, coal, iron, copper, manganese, tin, bauxite, chromite, nickel, cobalt, vanadium and phosphates.

- It serves as a catalyst for many nations. Japan imports almost 90 per cent of its oil from the IOR, Italy 85 per cent, Britain and Germany 60 per cent and France almost 50 percent.

- Economic Significance:

- It shares 64% of the global population and 60% of the global GDP

- The Indian Ocean is home to major sea routes connecting the Middle East, Africa and East Asia with Europe and the Americas.

- These vital sea routes (i) facilitate maritime trade in the Indian Ocean region, (ii) carry more than half of the world’s sea-borne oil (iii) host 23 of the world’s top 100 container ports.

- Container traffic through the region’s ports has increased fourfold from 46 million TEUs in 2000 to 166 million TEUs in 2017.

- Rich Resource Base: The Indian Ocean holds 16.8% of the world’s proven oil reserves and 27.9% of proven natural gas reserves.

Conclusion:

- There is a need to emphasize maintaining the Indian Ocean as a “free, open and inclusive space” where there should be “respect for sovereignty and territorial integrity” based on the UN Convention on the Law of the Seas.

- It also requires a broader vision of an Indo-Pacific that is built on a rules-based international order, rule of law, sustainable and transparent infrastructure investment, freedom of navigation and over-flight.

PYQs:

Q1. What are the maritime security challenges in India? Discuss the organisational, technical and procedural initiatives taken to improve the maritime security. (2022)

Q2. With reference to ‘Indian Ocean Rim Association for Regional Cooperation (IOR-ARC)’, consider the following statements: (2015)

- It was established very recently in response to incidents of piracy and accidents of oil spills.

- It is an alliance meant for maritime security only.

Which of the following statements given above is/are correct?

- a) 1 only

- b) 2 only

- c) Both 1 and 2

- d) Neither 1 nor 2.

RBI proposal to classify a borrower as “willful defaulter”

GS Paper III

Context:

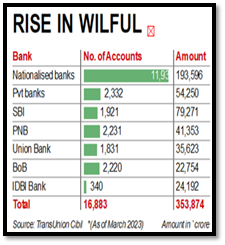

Banks are expected to witness a spike in willful defaults following the RBI proposal to classify a borrower as willful defaulter within six months of the account becoming a non-performing asset (NPA).

More details on news:

- The Reserve Bank of India has issued a draft paper proposing revisions in the guidelines for handling willful defaulters, wherein it has expanded the scope for regulated entities that can classify borrowers as willful defaulters and refined the identification process and mandates a review and finalisation on willful default aspects within six months of an account being classified as a non-performing asset.

- The RBI’s revision of norms came after a review of the instructions and consideration of various judgments and orders from the Supreme Court and High Courts, as well as representations and suggestions received from banks and other stakeholders.

- The willful defaulters will be eligible for compromise settlements as per a June 2023 circular of the RBI.

- The central bank has virtually reversed its earlier policy of keeping willful defaulters out of compromise settlement.

- In 2019 the RBI, in its ‘Prudential Framework for Resolution of Stressed Assets’, made clear that the borrowers who committed frauds/ malfeasance/ willful default would remain ineligible for restructuring.

|

Who are willful defaulters?

Compromise settlement

|

Criticism of RBI’s decision:

- The RBI’s latest ‘Framework for compromise settlements and technical write-offs’ is considered by some people as a “detrimental step that may compromise the integrity of the banking system and undermine the efforts to combat willful defaulters effectively”.

- It not only rewards unscrupulous borrowers but also sends a distressing message to honest borrowers who strive to meet their financial obligations.

- According to All India Bank Officers’ Confederation (AIBOC) and All India Bank Employees Association (AIBEA), allowing compromise settlement for accounts classified as fraud or willful defaulters is an affront to the principles of justice and accountability.

- The willful defaults have a significant impact on the financial stability of banks and the overall economy.

- As per bank unions, by allowing them to settle their loans under compromise, the RBI is essentially condoning their wrongful actions and placing the burden of their misdeeds on the shoulders of ordinary citizens and hardworking bank employees.

- Many in banking sector are afraid that the new decision will not only lead to erosion of public trust in the banking sector but also undermines the confidence of depositors.

How willful defaulters affect the economy?

- Impact on the Economy: The impact of willful defaulters is not limited to the banking sector; it also extends to the broader economy and can stifle economic growth.

- Affects the financial health of banks: Deliberate default on loans directly affects the financial health of the banks.

- Rising NPA: Willful defaulters contribute to the rising Non-Performing Assets (NPAs) in the banking sector.

- For example - Vijay Mallya, became a willful defaulter on loans exceeding Rs 9,000 crore, leading to a significant NPA issue for banks.

- Trust erosion: Willful defaulters erode the trust of banks and financial institutions.

- Example - Nirav Modi, who was involved in a massive fraud at Punjab National Bank, is an example of how trust can be severely damaged.

- Impact on market: When major business figures or companies are found to be willful defaulters, it can lead to a loss of investor confidence in the corporate sector, affecting stock prices and market stability.

Way forward:

- Reconsidering the decision of RBI: RBI should reconsider its proposal that allows compromise settlement with willful defaulters and fraud accounts.

- Strengthen the regulatory framework: Strengthen the legal and regulatory framework governing the banking sector to ensure that willful defaulters are held accountable.

- Action on Defaulters: Banks should take swift and decisive action when a borrower defaults.

- Better due diligence process: Before approving loans, due diligence process should be followed. Banks should conduct thorough credit assessments, background checks, and risk evaluations of borrowers.

- Implement robust monitoring system: To detect signs of financial distress in borrowers at an early stage, it is important to implement robust credit monitoring and early warning systems.

- Conduct regular reviews: To identify any irregularities or signs of default, regular reviews and audits of loan accounts should be conducted.

- Utilize advanced credit scoring models: Utilize advanced credit scoring models and risk management tools to assess the creditworthiness of borrowers more accurately.

- Whistleblower protection: Establish whistleblower protection mechanisms to report suspicious activities and fraudulent practices.

Conclusion:

Minimizing willful defaulters in the Indian banking system is a complex challenge, and it requires a multifaceted approach involving regulatory reforms, risk management, and a commitment to enforcing the rules and regulations in place. Therefore, addressing willful defaults and implementing effective measures to prevent them is essential for the RBI to ensure the stability and growth of the Indian economy.

PYQ

Q1. The term 'Core Banking Solutions' is sometimes seen in the news. Which of the following statements best describes/describe this term? (UPSC Prelims 2016)

- It is a networking of a bank's branches which enables customers to operate their accounts from any branch of the bank on its network regardless of where they open their accounts.

- It is an effort to increase RBI's control over commercial banks through computerization.

- It is a detailed procedure by which a bank with huge non-performing assets is taken over by another bank.

Select the correct answer using the code given below.

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

9th G20 Parliamentary Speakers' Summit,

2023 (P-20)

Context:

Recently, Prime Minister Narendra Modi inaugurated the 9th G20 Parliamentary Speakers' Summit (P20) in New Delhi. The summit was hosted by the Parliament of India under the broader framework of India’s G20 Presidency.

Key Highlights:

- In line with the theme of India’s G20 Presidency, the theme of the 9th P20 Summit is ‘Parliaments for One Earth, One Family, One Future’.

- Speakers of Parliaments of G20 members and invitee countries attended the event. The Pan-African Parliament also took part in the P20 Summit for the first time after the African Union became a member of G20.

- A pre-summit Parliamentary Forum on LiFE (Lifestyle for Environment) was also held to deliberate upon initiatives towards a greener and sustainable future in harmony with nature.

- On the conclusion of India’s P20 presidency, the Lok Sabha Speaker handed over the presidency to Parliament of Brazil.

|

LiFE (Lifestyle for Environment):

|

PYQs:

Q1. Describe the major outcomes of the 26th session of the Conference of the Parties (COP) to the United Nations Framework Convention on Climate Change (UNFCCC). What are the commitments made by India in this conference? (2021)

Q2. Explain the purpose of the Green Grid Initiative launched at World Leaders Summit of the COP26 UN Climate Change Conference in Glasgow in November, 2021. When this idea was first floated in the International Solar Alliance (ISA)? (2021)

Q3. “Momentum for Change: Climate Neutral Now” is an initiative launched by (UPSC CSE 2018)

- The Intergovernmental Panel on Climate Change

- The UNEP Secretariat

- The UNFCCC Secretariat

- The World Meteorological Organization.