Calibrating a strategy for India’s future growth

“Development is not just about building infrastructure, it is about empowering every citizen to realize their fullest potential.” – Manmohan Singh

Relevance: GS III (Indian Economy)

- Prelims: Real Interest Rates; Gross Fixed Capital Formation (GFCF); Incremental Capital-Output Ratio (ICOR)

- Mains: Deglobalization and its impact on the Indian Economy;

Why in the News?

India’s future growth strategy needs to be calibrated given the changing global conditions and uncertainty.

Issues related to Deglobalization:

- Changing Global Dimensions: Many ongoing geopolitical conflicts such as the Russia-Ukraine war and the Israel-Hamas war have created a climate of sanctions, leading to breaks in supply chains as well as disruptions in international settlements due to non-access to systems such as SWIFT for the sanctioned countries.

- GDP Growth: World real GDP growth has also fallen, reducing global export demand. Many countries including India want to reduce their dependence on imported petroleum due to supply uncertainties and price volatility.

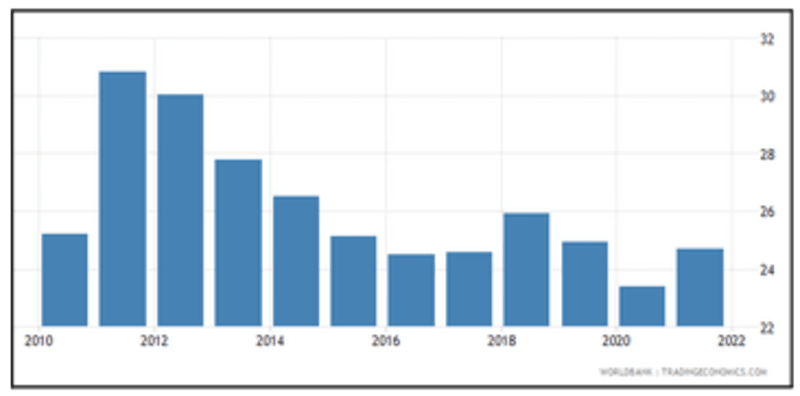

- Falling Exports: In India’s case, exports experienced a sharp acceleration in the share of GDP from 2003-04 to 2008-09. This peaked at 25% in 2013-14. In 2022-23, it was 22.8%, having fallen to a trough of 18.7% in 2019-20 and 2020-21.

- The erstwhile export-led growth strategy may not be available to India anymore. It has to evolve its future growth strategy.

Issue revolving around the Investment Rates in Medium Term:

India will have to rely relatively more on domestic growth drivers. To achieve and sustain a 7% plus real growth, in particular, domestic savings will be critical.

- Fall in Household sector - areas of concern:

-

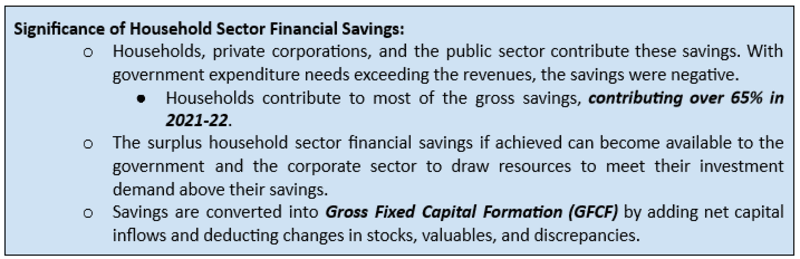

- Recently, the GDP in 2022-23 declined to 5% due to a fall in the household sector’s savings in financial assets. Previously, during pre-COVID, it was 7.8% (2015-16 to 2019-20) — a fall of 2.7% points.

- Government dissaving has averaged 2.1% of GDP in the past 10 years.

- Recently, the GDP in 2022-23 declined to 5% due to a fall in the household sector’s savings in financial assets. Previously, during pre-COVID, it was 7.8% (2015-16 to 2019-20) — a fall of 2.7% points.

-

- However, if these trends persist, it will pose a significant risk to India’s growth potential.

India towards Strategizing and Enhancing Employment:

India will find itself in a unique position in the next three decades with a large potentially employable population seeking jobs in the presence of progressively more labor-saving innovations and technologies.

- Projections related to India’s Working Age Population:

-

- In 2022-23, according to the Periodic Labour Force Survey (PLFS), the worker-population ratio, showing the number of employed persons in the population above 15 years of age, increased to 51.8% from 44.1% in 2017-18, depicting an average increase of 1.5% points per year.

- According to United Nations population projections, the share of India’s working-age population is projected to peak at 68.9% in 2030 while its overall dependency ratio would be at its lowest at 31.2%.

-

-

- Employment growth is critically dependent on GDP growth and the structure of output. The growth rate of the working-age population is projected to progressively fall from 1.2% in 2023-24 to 0% in 2048-49.

-

- Initiatives taken up to date:

- India has committed to certain targets to reduce carbon emissions because of global climate concerns. In the COP26 Summit, in 2021, India had committed to reducing total carbon emissions by one billion tonnes between 2021 to 2030 and achieving the target of net zero emissions by 2070.

- India’s initiatives include the Green Grids Initiative (GGI) and One Sun One World One Grid (OSOWOG). It is also emphasizing the use of electric vehicles and ethanol-based and hydrogen fuels.

Way Forward:

What can be done for Investment Rates in Medium Term?

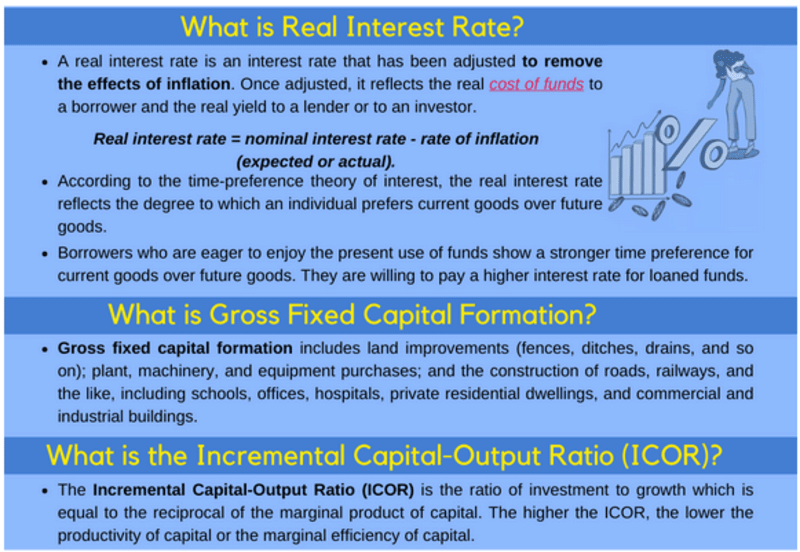

- Need to understand volatility in the market: The movement of the relative deflator of capital goods is somewhat volatile. Using the five-year average of the relative magnitude of the two deflators, the nominal investment rate of nearly 29% would provide a real investment rate of about 33%.

- Need to change the measures and magnitude: The Real Investment Rate needs to be increased by 2% points to provide investible resources amounting to 35% of GDP, enabling growth of 7% at an Incremental Capital-Output Ratio (ICOR) of 5, which was its value in 2022-23. If the ICOR is lower, achievable growth would be higher.

What more needs to be done for Strategizing and Enhancing Employment?

- Need for skilling the working population: The recent patterns call for increased allocation of resources for training and skilling India’s growing working-age population.

- Need to analyze changing trends: Non-agricultural growth will have to be high enough to absorb labour released from agriculture which is estimated at 45.8% in 2022-23 by the PLFS. It should also be able to absorb the labor-substituting impact of new technology.

- Facilitating the absorption of productivity-enhancing technologies including Artificial Intelligence (AI) and Generative AI would add to overall growth.

- Climate-promoting technological changes may reduce the potential growth rate. This adverse impact can be minimized by emphasizing service sector growth which is relatively climate-friendly.

What needs to be done around Fiscal Responsibility?

- Reducing the Interest Burdens: To sustain growth close to its potential, it is important to ensure that the combined fiscal deficit and debt-to-GDP ratios are brought down to 6% and 60%, respectively, so that the burden of interest payments relative to revenue receipts is kept within acceptable limits.

Conclusion:

In the next two years, a growth rate of 6.5% seems feasible. This represents, partially, a recovery from the low growth rate in the COVID-19 period. Over the medium term, India’s growth performance will be adversely affected by many factors, both domestic and external.

BEYOND EDITORIAL:

Government’s Initiatives:

- Insolvency and Bankruptcy Code (IBC, 2015): The IBC has successfully addressed delinquency and lowered the non-performing assets in the banking sector, setting the stage for private corporate investment to take off.

- Goods and Services Taxes (GST, 2017): GST rolled out in 2017 has mobilized higher revenues and unified fragmented markets to build economic synergies.

- The reduction in the corporate tax rate in 2019 to one of the lowest in the world has increased corporate reserves, which are being leveraged to finance higher investments.

- These reforms have led to a strong churning of the economy, shutting out enterprises that deviated from market principles.

- Sabka Saath Sabka Vikas: Relentless government support towards livelihood enhancement, skill development, women’s empowerment, and infrastructure development has played a vital role in reducing the incidence of poverty in India.

- Capex Programme (2022): The government embarked on a large Capex program and provided resource support to State governments to increase their Capex budget.

- The idea behind the upscaling of the Capex budget was to not only plug gaps in physical infrastructure but also to “crowd-in” private corporate investment, which was investment-ready, having repaired its balance sheet and progressed to an optimal level of capacity utilization.

- Data from Axis Bank shows private corporate investment rose by 22.4% in FY23, with 15 out of 19 sectors witnessing an expansion in private capital investment.

Mains PYQs

Q. What were the reasons for the introduction of the Fiscal Responsibility and Budget Management (FRBM) Act, 2013? Discuss critically its salient features and their effectiveness. (2013)

Q. The multiplicity of various commissions for the vulnerable sections of society leads to problems of overlapping jurisdiction and duplication of functions. Is it better to merge all commissions into an umbrella Human Rights Commission? Argue your case. (2018)

Prelims PYQs:

Q. Which one of the following statements appropriately describes the "fiscal stimulus"? (2011)

(a). It is a massive investment by the Government in the manufacturing sector to ensure the supply of goods to meet the demand surge caused by rapid economic growth.

(b). It is an intense affirmative action of the Government to boost economic activity in the country.

(c). It is the Government's intensive action on financial institutions to ensure the disbursement of loans to agriculture and allied sectors to promote greater food production and contain food inflation.

(d). It is an extreme affirmative action by the Government to pursue its policy of financial inclusion.