ECONOMIC SURVEY-

- It is an in-depth analysis of the state of the national economy in the financial year that is coming to a close.

- Under the direction of the Chief Economic Advisor, it is created by the department of economic affairs (DEA) economic division. The finance minister approves the survey after it has been created.

Chapter 1- the state of the economy 2022-23

The global economy battles through a unique set of challenges -

- The first threat to the third world decade that hampered global growth was the COVID-19 pandemic, which the WHO announced in January 2020.

- After the global economy was recovering from the pandemic inducted contraction, the Russia-Ukraine conflict -

- erupted in February 2022, sending commodity prices into a whirl and escalating already-present inflationary pressures.

- Prices of essential commodities like crude oil, natural gas, wheat, and fertilizer skyrocketed due to the fighting.

- The Emerging Market Economies (EMEs), which were otherwise in the lower inflation zone because their governments had implemented a calibrated fiscal stimulus to address output decline in 2020, also experienced greater inflation due to rising commodity prices.

- The third challenge- emerged when nations undertook monetary tightening to refrain from inflation, causing growth to weaken.

- Monetary tightening also drove capital flows to the safe- haven US market, contributed to rising sovereign bond yield, and depreciation of modern currencies against the US dollar.

- Inflation and monetary tightening led to a hardening of bond yield across economies. They resulted in an outflow of equity capital from most of the economies around the world into the traditionally safe-haven market of the US.

- The capital flight subsequently strengthened the US dollar against other currencies- the US Dollar index strengthened by 16.1% between January and September 2022.

- The CAD has widened due to the other currencies' devaluation, increasing inflationary pressures in net importing nations.

- Beginning in the second half of 2022, monetary tightening and rising inflation caused a decline in worldwide output.

- Since August 2022, the global Purchasing Managers Index (PMI) composite index has been in the contractionary range. In the second half of 2022, the annual growth rates of international commerce, retail sales, and industrial production have all dramatically slowed.

- High levels of governmental and private debt were further pressured by the rise in borrowing costs, endangering the financial system.

- The fourth obstacle to growth was caused by countries slowing cross-border commerce to defend their respective economic spaces in the face of the possibility of global stagflation.

- The fifth issue was growing as China went through a significant slowdown brought on by its policies.

- The loss of educational chances and income-generating prospects brought on by the pandemic represents the sixth medium-term threat to growth.

Macroeconomic and growth challenges in the Indian economy-

- The pandemic's effects on India were seen in a sizable GDP decline in FY21.

- Despite the Omicron wave of January 2022, the Indian economy began to improve the next year or FY22.

- Since the pandemic's outbreak in January 2020, the third wave has had a different impact on India's economy than its earlier waves.

- Mobility enabled by localized lockdowns, rapid vaccination coverage, mild symptoms, and quick recovery from the virus contributed to minimizing the loss of economic output in the January-March quarter of 2022.

- As a result, output in FY22 exceeded FY20 prior to the pandemic, with the Indian economy leading the way in a full recovery.

- A cautious optimism that it was possible to maintain physical mobility and engage in economic activity even though the experience inspired the pandemic with the Omicron variety.

- Thus, FY23 began with the conviction that the pandemic was swiftly abating and that India was ready to expand quickly and return to its pre-pandemic growth trajectory.

- The US dollar has gained value against several currencies, including the rupee, due to monetary tightening.

- However, while being one of the better-performing currencies globally, the rupee's slight devaluation may have increased domestic inflationary pressures and widened the CAD.

- Despite a small decline, global commodity prices are still higher than before the conflict.

- Due to India's growing pace, they have already increased CAD's size.

- India has enough foreign exchange reserves for FY23 to cover the CAD and intervene in the foreign exchange market to control currency volatility.

India's economic resilience and growth drivers-

- Geopolitical unrest in Europe has largely been the cause of the RBI's tightening of monetary policy, the widening of the current account deficit, and the plateauing growth of exports.

- Numerous organizations around the world have been lowering their growth projections for the Indian economy as a result of these developments, which posed hazards to the country's economy in FY23.

- These predictions, including the NSO's advance estimations, generally fall between 6.5 and 7.0 per cent.

- Despite the downward revision, the growth projection for FY23 is higher than that of nearly all major nations and even somewhat higher than that of the Indian economy over the decade prior to the pandemic.

- In 2022, according to the IMF, India will have one of the two fastest-growing large economies.

- If India is predicted to grow between 6.5 and 7.0 per cent despite significant global headwinds and tighter domestic monetary policy, and that too without the benefit of a base effect, it is a testament to India's underlying economic resilience and its capacity to recover, renew, and re-energize the country's growth drivers.

- The single most significant factor that led people to the streets to re-experience the "bazaar" was the nearly universal vaccination coverage in India, which the government managed. The market quickly became crowded, with service providers returning to resume business.

- The contact-based service providers, including those in restaurants, hotels, shopping centres, movie theatres, and tourist attractions, quickly built up a booming business and made a big contribution to maintaining customer feelings, as recorded in numerous studies.

- If the widespread vaccination program saved lives, on the one hand, it also acted as a health stimulant to boost consumer confidence and, in turn, the recovery and expansion of the economy.

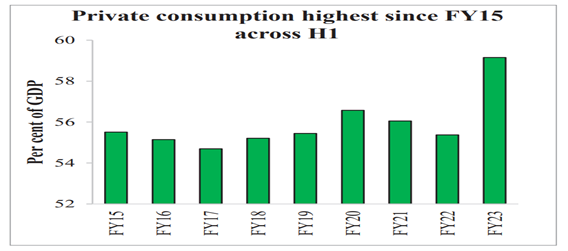

- The release of "pent-up" demand, which is not specifically an Indian occurrence but demonstrates

- a local phenomenon impacted by a growth in the percentage of consumption in disposable income, has also contributed to the recovery in consumption.

- An even more significant recoil effect was created in India, where a major part of disposable income is spent as a result of a pandemic-induced decline in consumption.

- Consequently, the consumption rebound can be long-lasting.

- In India, personal loan growth is accelerating, which attests to a persistent discharge of "pent-up" consumer demand.

- The housing market also saw the "release of pent-up desire."

- Demand for housing loans picked up.

- As a result, housing inventories have decreased, home prices are stabilizing, and new home development is accelerating.

- The building industry is recognized to carry numerous backward and forward links, stimulating them.

- The universalization of vaccine coverage also significantly improves the housing market since, without it, the migrant labour force would not have been able to return and build new homes.

- Aside from housing, construction activity increased dramatically in FY23 as the central government and its public sector firms quickly deployed their much-expanded capital expenditure (Capex).

- The business investment and industrial operations have recovered due to an improvement in export demand, a pickup in consumption, and public capital expenditures. Their improved balance sheets have also played a significant role in achieving their spending commitments.

- India's banking industry has equally responded to the need for credit.

- The credit growth to the MSME sector has been remarkably high, over 30.5 per cent, on average, during Jan-Nov 2022, supported by the extended ECLGS of the central government.

- The public sector banks' financial situation has significantly improved due to profits being posted consistently and the Insolvency and Bankruptcy Board of India moving quickly to resolve or liquidate their non-performing assets (NPAs).

- In order to maintain the PSBs' strong capitalization and ensure that their Capital Risk-Weighted Adjusted Ratio (CRAR) stays comfortably above the levels of adequacy, the government has been providing enough budgetary support.

- Banks' financial stability has enabled them to offset the decreased debt financing supplied so far in FY23 by corporate bonds and external commercial borrowings (ECBs). Corporate bond yields have increased, while ECB interest and hedging expenses have increased, making these securities less appealing than last year.