Tax ‘HFSS’ foods, view it as a public health imperative

“The industrial food complex polluted our food system to please the addicted palettes they created.” - Donna Maltz,

Relevance: GS I (Social Issues)

- Prelims: GST on Food;

- Mains: Non-Communicable Diseases (NCDs); Health Care and Public Health Imperative;

Why in the News?

The Non-Communicable Diseases (NCDs) and their economic burden in India have skyrocketed since 1990 and further is likely to rise to $480 billion by 2060.

About:

- The consumption of High Fat Sugar Salt (HFSS) foods is one of the major risk factors globally as well as nationally for a host of health issues that include obesity, diabetes, and high blood pressure.

- The Non-Communicable Diseases (NCDs) burden in India has skyrocketed from 38% in 1990 to 65% in 2019. The global burden of diseases study shows that annually, 1.2 million deaths in India can be attributed to dietary risks alone.

- India logged 31 million new diabetes patients in 2019-21.

- The economic impact of overweight and obesity in India was estimated at $23 billion in 2017. If unattended, this is likely to rise to $480 billion by 2060.

India’s shift in dietary habits

- Indian Scenario: Increase in the ultra-processed food:

- India witnessed a compounded annual growth rate of 13.4% between 2011 and 2021. As the world’s largest producer and consumer of sugar in 2022, the country has seen an alarming surge in consumption of HFSS foods.

- About 50%-60% of edible sugar, salt, and fat produced in India are consumed by the processed food industry.

- Sales of snacks and soft drinks have tripled over the past decade, exceeding $30 billion last year, indicating a disturbing trend in dietary habits.

- This not only poses severe health risks but also impacts productivity and economic growth, necessitating urgent interventions to curtail the rising consumption of these products.

- In India, Kerala introduced a ‘fat tax’ way back in 2016, which later got subsumed into India’s Goods and Services Tax in 2017.

- Global Scenario:

- There is a global trend of utilizing fiscal measures to combat obesity. Taxation is considered to be an effective means to reduce the consumption of these products as most consumers are price-responsive towards them.

- While taxation on sugar-sweetened beverages (SSBs) is far wider and used in more than 60 countries, taxation on HFSS food is less common, although rapidly increasing.

- Countries like Denmark, France, Hungary, Mexico, South Africa, the United Kingdom, and the United States, among others, now have a dedicated tax on HFSS foods.

-

- Most recently, Colombia’s “junk food law” introduced a gradually increasing levy on ultra-processed foods, providing a model for other nations.

How the high HFSS tax can play an effective role?

- The imperative taxing of HFSS comes in display due to the significant market failures associated with their consumption, which have contributed to negative externalities and internalities as follows:

- Negative Externalities: It manifests as societal costs in the form of increased health-care expenditures.

- For example, the escalation of diabetes and obesity due to increased HFSS consumption leads to external costs imposed on society, necessitating substantial healthcare expenditures, borne through elevated taxes to finance public health insurance such as the Ayushman Bharat Yojana.

- Negative Internalities: It manifest from consumers’ limited understanding (awareness), and influenced by aggressive marketing, results in inadvertent harm to themselves.

- Taxes can offer a targeted and effective means to curb detrimental consumption habits, thereby reducing societal burdens. Implementing such taxes has shown promise in various countries, demonstrating a reduction in the purchase of unhealthy items.

- As a fiscal means: The HFSS taxation need not be viewed as a means for raising revenue and also as a fiscal tool to incentivize the industry to reformulate the products more in favor of healthier alternatives and for people to reorganize their food consumption basket in favor of a healthier diet.

- If properly designed, HFSS food tax can be both non-regressive and fiscally neutral.

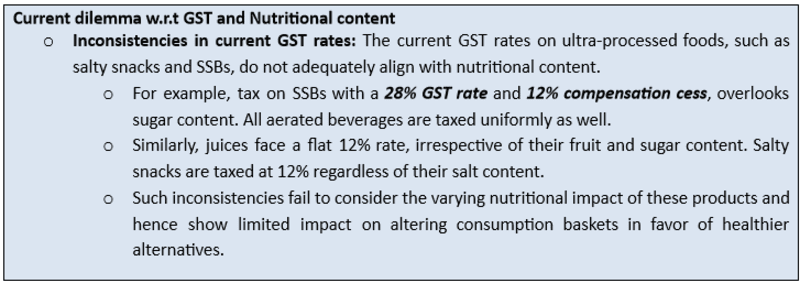

- As a Product Formulator: Tax rates need to be differentiated based on the nutritional quality of the food so as to incentivize product reformulations.

- For Example, it is possible to have a GST system with HFSS foods in the highest rate structure while their healthier alternatives have either zero or minimal tax rates so that the net tax burden on a household’s food consumption basket remains the same.

- This would create a level-playing field between HFSS and their healthier alternatives, making healthier food choices more affordable and accessible.

Way Forward:

- Rationalization: HFSS taxation in India should not be merely seen as an Economic or Fiscal Policy concern but it deserves to be considered a public health imperative.

- Catering parallel outcomes: Effectively designed taxes can reap multiple benefits, they can act as a deterrent to consuming HFSS; promote healthier food choices; prompt manufacturers to reformulate foods; improve public health outcomes; reduce the burden on the health-care system, and foster the nation’s well-being.

- Awareness: When combined with other measures such as the promotion of nutrition literacy and effective food labeling, it can be a more potent tool to combat the rising epidemic of overweight and obesity by creating a more sustainable and equitable food system.

Mains PYQs

Q. The increase in life expectancy in the country has led to newer health challenges in the community. What are those challenges and what steps need to be taken to meet them? (2022)

Q. Critically examine the effects of globalization on the aged population in India. (2013)