GS Paper III

News Excerpt:

The Georgia Tech Research Institute (GTRI) stated that India should become a middle-income country first and then push to make INR (Indian Rupee) a hard currency. Until then, it must promote global trade settlement in the local currency.

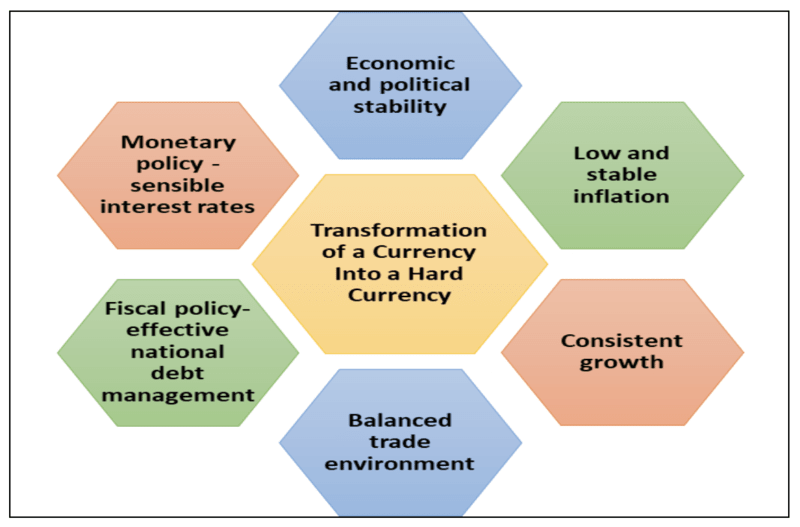

What is a Hard Currency?

- Any currency is typically accepted as a hard currency when it is widely used and trusted, and reciprocally, it gains trust because of its widespread use.

- Hard currencies are widely accepted worldwide for international transactions and are considered a reliable and stable store of value.

- The presence of a currency as a hard currency reflects its issuing country's perceived stability, reliability, and economic strength. This stability underpins confidence among international investors and trading partners.

The most recognised hard currencies and their approximate global share in international transactions include the US Dollar (60%), Euro (20%), Japanese Yen, etc.

Concerns associated with INR to become Hard Currency:

- The INR’s international trade has a limited role, especially compared to established hard currencies like the US Dollar, Euro, or even the Chinese Yuan.

- No full capital account convertibility: To become a hard currency, a currency must be fully convertible on a capital account.

- Persistent trade deficits: They exert downward pressure on the rupee, undermining efforts towards currency stability.

- Sectoral Reforms: Financial system reforms, encompassing both banking and non-banking sectors, pose risks of destabilisation during the transition.

Significance of trading in Local Currency:

- It reduces transaction costs by eliminating the need to convert currencies twice. For example, an Indian company importing machinery from Russia must buy dollars, incurring a premium. Then, the Russian counterpart would convert these dollars into Russian Roubles, again incurring a conversion cost.

- Local currency trading would allow direct conversion between INR and Rouble, reducing these costs.

- The local currency would give banks a reliable reference for issuing letters of credit and help businesses understand currency volatility better.

The recent introduction of the system for settling international trade transactions in INR in 2022 by the Reserve Bank of India will help to make local currency settlements of trade more robust.

Prelims PYQ

Q. In the context of India, which of the following factors is/are contributor/contributors to reducing the risk of a currency crisis? (UPSC 2019)

1) The foreign currency earnings of India’s IT sector

2) Increasing the government expenditure

3) Remittances from Indians abroad

Select the correct answer using the code given below.

(a). 1 only

(b). 1 and 3 only

(c). 2 only

(d). 1, 2 and 3